Insight

Do you know the truth about these three hedge fund myths?

Introduction

Allocators considering investing in hedge funds for the first time have to navigate a number of widely held misconceptions about the asset class. Perhaps more than any other financial asset, hedge funds have a certain mystique about them. In the third part of Aurum’s “hedge fund basics” series, we explore some of the most common myths about hedge funds. We look at hedge fund risks, hedge fund liquidity and the type of typical hedge fund investors.

About Aurum

Aurum is an investment management firm focused on selecting hedge funds and managing fund of hedge fund portfolios for some of the world’s most sophisticated investors. Aurum also offers a range of single manager feeder funds.

Aurum’s portfolios are designed to grow and protect clients’ capital, while providing consistent uncorrelated returns. With 30 years of hedge fund investment experience, Aurum’s objective is to lower the barriers to entry enabling investors to access the world’s best hedge funds.

Aurum conducts extensive research and analysis on hedge funds and hedge fund industry trends. This research paper is designed to provide data and insights with the objective of helping investors to better understand hedge funds and their benefits.

Hedge funds are risky

Hedging was specifically developed as a tool to manage portfolio risk, however, over time, and in light of stories in the media about some spectacular fund failures, hedge funds have gained a negative reputation for engaging in risky behaviour.

Hedge fund strategies vary enormously, and different strategies have different risks associated with them. As mentioned in part one, leverage, which is generally employed by funds in the hope of amplifying returns, also has the associated risk of potentially magnifying losses. However, the level of leverage employed varies a lot, and it tends to be less volatile strategies that have more modest returns (e.g. fixed income arbitrage, market neutral strategies etc.) that employ the largest amount of leverage.

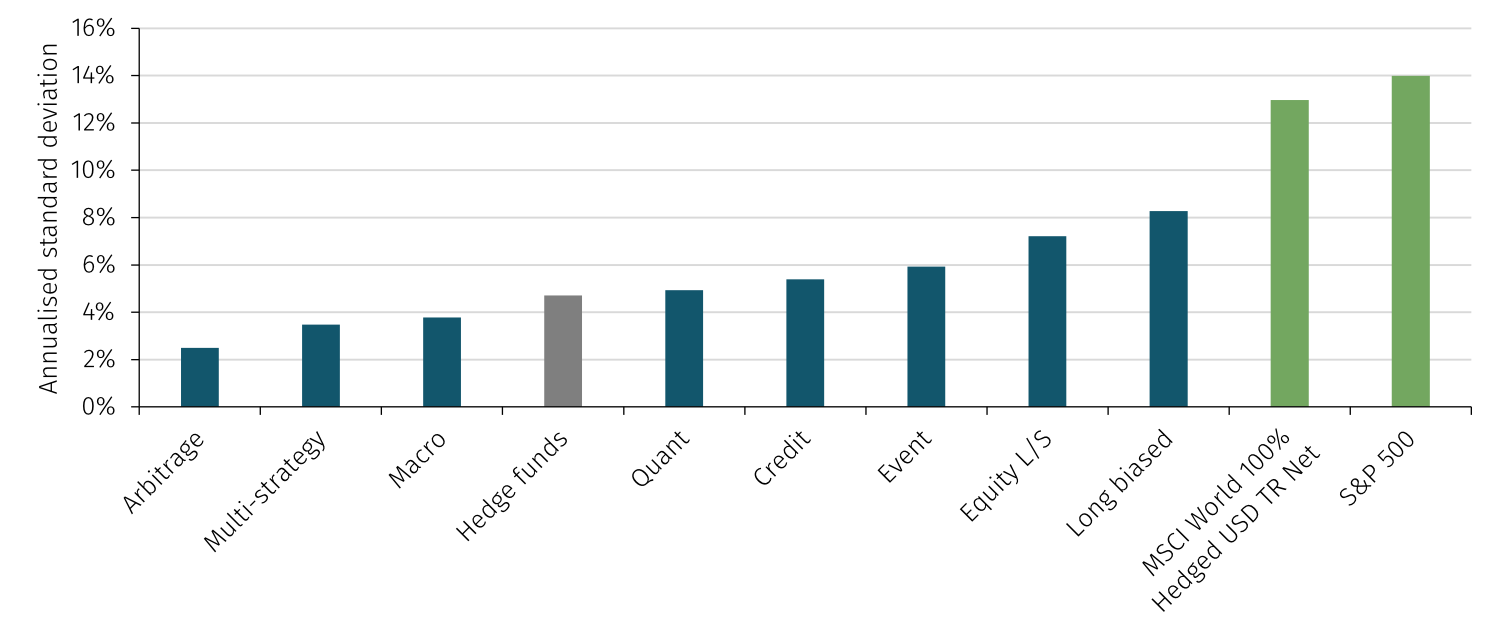

In reality, most hedge funds are conservatively run and actively seek to avoid losses. Using volatility (measured by annualised standard deviation) as an indicator of risk, we can see below in Figure 1, that when compared to long-only equity portfolios, hedge funds have considerably lower risk.

FIGURE 1: ANNUALISED STANDARD DEVIATION (JAN 2013 – JUN 2022)

Source: Aurum Hedge Fund Data Engine/Bloomberg

Hedge funds are illiquid

Hedge fund subscription and redemption terms are, in general, less liquid than long-only funds. Different hedge funds, with different underlying investments, offer investors a broad range of liquidity profiles. Hedge fund liquidity can range from daily, to monthly, quarterly, annually or beyond. However, it is important to note that hedge funds are, typically, more liquid than other alternative assets such as private equity, property and infrastructure.

The liquidity terms offered to investors in a hedge fund generally determine the breadth of investment opportunities a fund can participate in. A fund with daily liquidity has a much more restricted investment universe than a fund with longer redemption terms.

Many hedge funds invest in the most liquid underlying asset classes, e.g. equities, government bonds etc. Despite this, many funds still have medium or long-term liquidity profiles. This is sometimes to take account of the complexity of hedge fund portfolios, the many underlying investments, and the time it takes to unwind multiple trades. Some hedge funds utilise lock-up periods so that concentrated positions can be unwound over time, without an adverse impact on the price of a holding. But lock-up periods can also be employed by hedge fund managers as a way to retain capital, where the liquidity terms of the fund are more stringent than the underlying portfolio necessitates.

Hedge funds that invest in the most illiquid underlying assets, for example distressed debt, tend to be structured with a private equity type fund structure, rather than as a hedge funds.

So whilst hedge funds do not have the liquidity profile of mutual funds, most offer investors regular liquidity that is consistent with the nature of the assets traded within the fund and to facilitate orderly management of the fund.

Hedge funds are just for wealthy investors seeking higher risk and returns

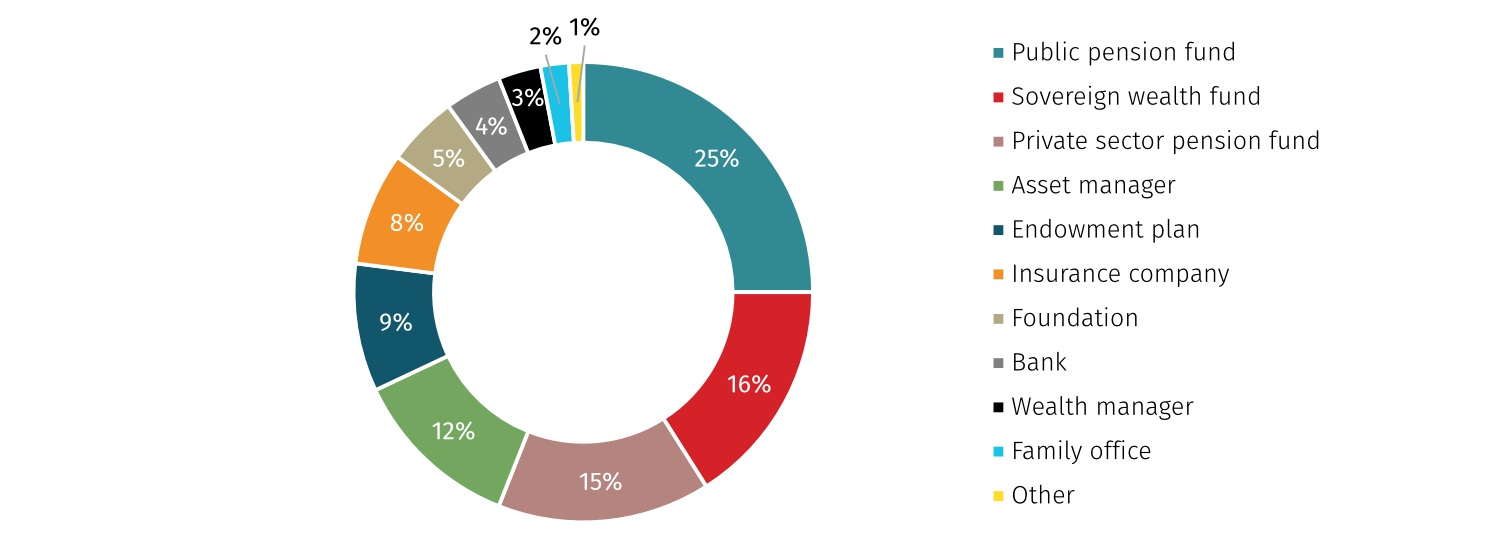

Whilst the perceived image of hedge fund investors may be high net worth individuals looking to generate high returns, the reality is that the majority of hedge fund investors tend to be large, institutional, low-risk investors. Many of these are investing on behalf of their underlying beneficiaries, such as pension funds. Institutional investors, such as pension funds, endowments or insurance companies amongst others, with conservative risk management frameworks make up 97% of hedge fund investors (Source: Preqin Hedge Fund Investor Profiles, see Figure 2 below).

Despite the perception that hedge funds are the preserve of the super-rich, most people will probably have some exposure through a holding in their pension which they may not be aware of.

FIGURE 2: HEDGE FUND INVESTORS

Source: Preqin Hedge Fund Investor Profiles 2020

Hedge funds might once have been publicity shy and rather complex, and some of them still are, with myths about the asset class arising as a result. However, hedge funds have the potential to benefit investors by diversifying portfolios and thus mitigating the risks typically associated with traditional investments. In the next in our hedge fund basics series, we will look at different hedge fund strategies, and why not all hedge funds may offer the diversification and portfolio protection investors are seeking.

Hedge fund basics series

See the full series here

*The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Data from the Hedge Fund Data Engine is provided on the following basis: (1) Hedge Fund Data Engine data is provided for informational purposes only; (2) information and data included in the Hedge Fund Data Engine are obtained from various third party sources including Aurum’s own research, regulatory filings, public registers and other data providers and are provided on an “as is” basis; (3) Aurum does not perform any audit or verify the information provided by third parties; (4) Aurum is not responsible for and does not warrant the correctness, accuracy, or reliability of the data in the Hedge Fund Data Engine; (5) any constituents and data points in the Hedge Fund Data Engine may be removed at any time; (6) the completeness of the data may vary in the Hedge Fund Data Engine; (7) Aurum does not warrant that the data in the Hedge Fund Data Engine will be free from any errors, omissions or inaccuracies; (8) the information in the Hedge Fund Data Engine does not constitute an offer or a recommendation to buy or sell any security or financial product or vehicle whatsoever or any type of tax or investment advice or recommendation; (9) past performance is no indication of future results; and (10) Aurum reserves the right to change its Hedge Fund Data Engine methodology at any time and may elect to supress or change underlying data should it be considered optimal for representation and/or accuracy.

Disclaimer

This Post represents the views of the author and their own economic research and analysis. These views do not necessarily reflect the views of Aurum Fund Management Ltd. This Post does not constitute an offer to sell or a solicitation of an offer to buy or an endorsement of any interest in an Aurum Fund or any other fund, or an endorsement for any particular trade, trading strategy or market. This Post is directed at persons having professional experience in matters relating to investments in unregulated collective investment schemes, and should only be used by such persons or investment professionals. Hedge Funds may employ trading methods which risk substantial or complete loss of any amounts invested. The value of your investment and the income you get may go down as well as up. Any performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable indicator of future results. Returns may also increase or decrease as a result of currency fluctuations. An investment such as those described in this Post should be regarded as speculative and should not be used as a complete investment programme. This Post is for informational purposes only and not to be relied upon as investment, legal, tax, or financial advice. Whilst the information contained in this Post (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Aurum to be reliable, it is not guaranteed as to its accuracy or completeness. This Post is current only at the date it was first published and may no longer be true or complete when viewed by the reader. This Post is provided without obligation on the part of Aurum and its associated companies and on the understanding that any persons who acting upon it or changes their investment position in reliance on it does so entirely at their own risk. In no event will Aurum or any of its associated companies be liable to any person for any direct, indirect, special or consequential damages arising out of any use or reliance on this Post, even if Aurum is expressly advised of the possibility or likelihood of such damages.