Insight

Portfolio optimisation – Building a hedge fund portfolio

Since the introduction of modern portfolio theory by Harry Markowitz in 1952, portfolio optimisation has been well debated amongst investment professionals. The goal of any portfolio optimiser is to select the best portfolio out of all possible portfolios, according to the investment objective. The objective typically seeks to maximise the expected return while controlling for the acceptable level of risk. Modern portfolio theory measures the effects of diversification when risks are correlated, and provides a framework for measuring diversification.

In Aurum’s 26 years of experience in managing fund of hedge fund portfolios, we are very much aware of the complexities of portfolio optimisation when building a portfolio of hedge funds in the real-world.

What are we dealing with?

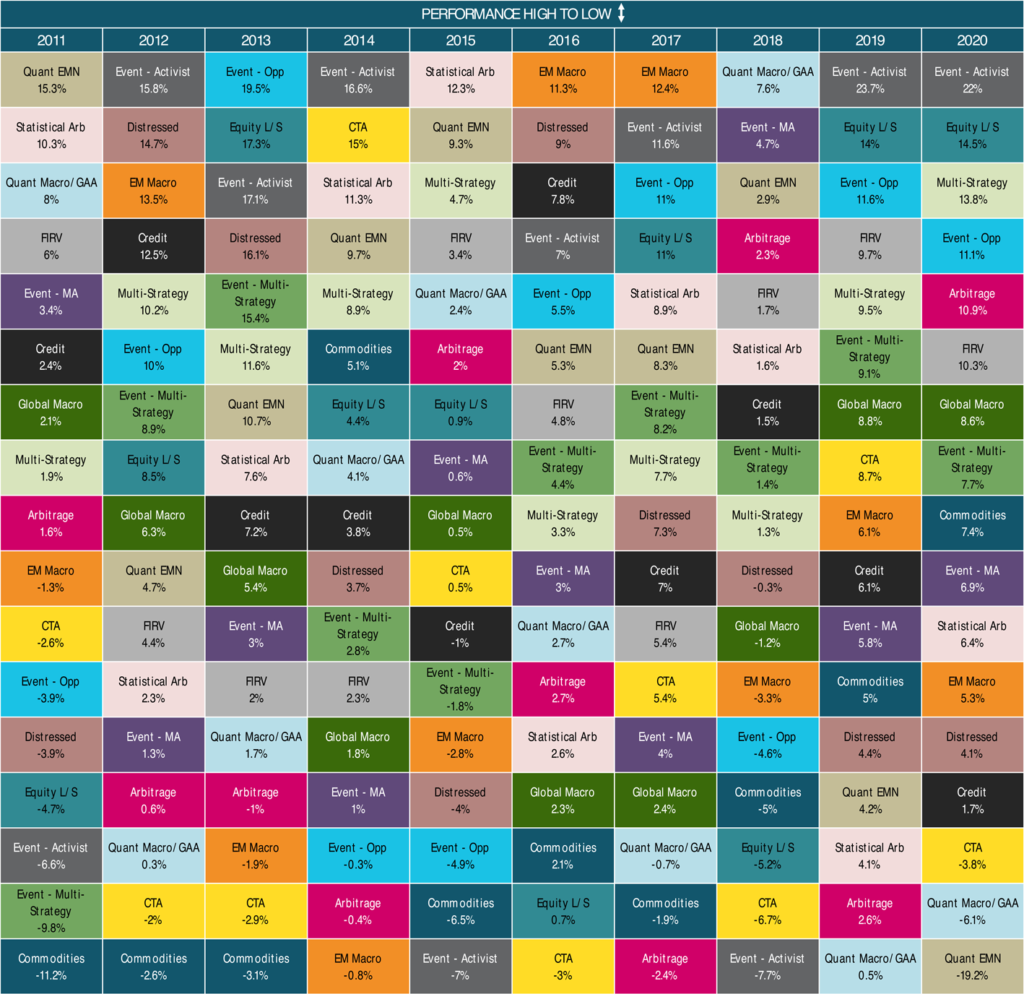

Examining the performance of hedge fund strategy returns over the last ten years reveals that over the long-term, diversification by strategy is extremely important in order to achieve optimal risk-adjusted returns. Using Aurum’s hedge fund data engine[1] – a proprietary database of the returns of just under 4,000 funds – we are able to aggregate and analyse the various strategy returns from 2011 to 2020.

The colour map below (Figure 1), which orders the best performing strategies sequentially from the top of the chart, highlights:

- How diverse the returns are across different strategies;

- That individual strategy performance can be highly cyclical,

- A top performing strategy in one year may underperform in the next

FIGURE 1: NET RETURNS

Source: Aurum Hedge Fund Data Engine

Portfolio optimisation – approaches

In order to understand the importance of portfolio optimisation, we will explore three different approaches to long-term strategic asset allocation across hedge fund strategies:

- Equal weighted approach[2]

- Equal volatility weighted approach (risk-parity)[3]

- Mean-variance optimisation (Markowitz)[4]

Data sample

In review of each of the approaches we have utilised ten years of in-sample data (Jan 2001 to Dec 2010) and ten years of out-of-sample data (Jan 2011 to Dec 2020). Since we are trying to illustrate the importance of strategic asset allocation, we will ignore tactical asset allocation[5] considerations in this analysis.

The data for our analysis consists of 17 core hedge fund strategies[6] (as shown in Figure 1, for strategy definitions please click here) with each strategy comprising of a minimum 20 funds to ensure robustness in our back test. We limit maximum strategy exposure to 30% to ensure a minimum level of diversification is maintained when implementing the equal weighted risk approach and mean-variance optimisation. Using data from 2001 allows the model to optimise over a business cycle in each of the two data sets.

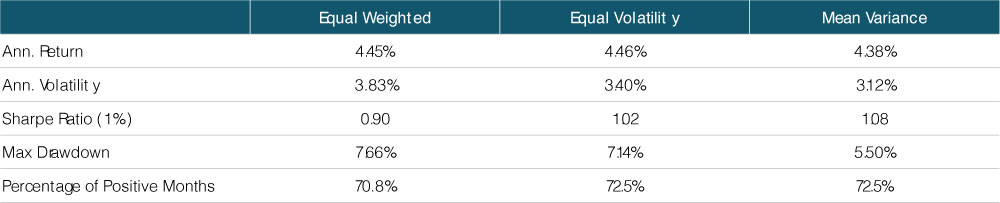

FIGURE 2: PORTFOLIO OPTIMISATION – RESULTS (JAN 2011 TO DEC 2020)

Source: Aurum Hedge Fund Data Engine

Figure 2 shows:

- The simple volatility weighted approach slightly outperforms an equal weighted portfolio out-of-sample.

- From a risk (volatility and drawdown) perspective, a mean variance optimisation for the highest Sharpe ratio delivers the least risky portfolio out-of-sample.

- Both an equal volatility and mean-variance portfolio exhibits better risk/return characteristics than an equal weighted portfolio as illustrated by the improved Sharpe ratio.

- Overall a mean-variance optimised portfolio has the most compelling risk-adjusted statistics and the lowest drawdown.

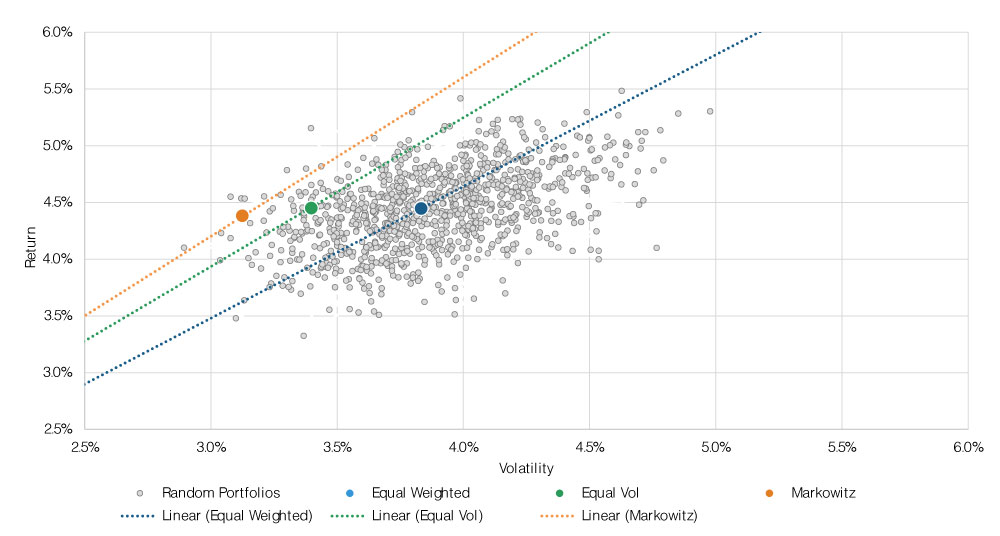

Effectiveness – Monte Carlo[7] simulation

To explore the effectiveness of the three optimised portfolios further, we carry out a Monte Carlo simulation, using 1,000 randomly selected portfolios. The scatter plot (Figure 3) provides a visual representation of the risk-return statistics for the random portfolios against the three out-of-sample portfolios (equal weighted, equal volatility and mean-variance). For each optimised portfolio, we display the capital market line (CML), illustrating where all portfolios on the CML have the same risk/return characteristics as the optimised portfolio.

FIGURE 3: MONTE CARLO[7] SIMULATION

Source: Aurum Hedge Fund Data Engine

The scatter plots demonstrates that effective portfolio optimisation can significantly enhance the risk-adjusted returns over randomly selected portfolio allocations.

Why wouldn’t every hedge fund allocator utilise portfolio optimisation methodologies when constructing their portfolio?

In answer to this point, it’s important to understand some of the potential drawbacks of using mean-variance optimisation including the following:

- Mean-variance optimisation assumes that returns, volatility and correlations are stable over time. Agarwal and Naik (2000)[8] concluded that there is a considerable amount of persistence in hedge fund strategy returns over the short-term, but this diminishes over the long-term.

- It also assumes that strategy returns are normally distributed. Glosten and Jagannathan (1994)[9] first highlighted the non-linear option-like payoff profile for hedge funds. Further analysis by Fung and Hsieh (2001)[10] and Mitchell and Pulvino (2001)[11] supplement this study.

- Mean-variance optimisation fails to capture risk in the tails. Hedge fund crowding or factor unwinds can expose some strategies to tail risk or ‘black swan’ type events.

Aurum’s approach to portfolio optimisation

At Aurum, we take a pragmatic approach when building portfolios. We favour a bottom-up approach to portfolio construction, conducting deep fundamental research that enables us to identify the differentiated sources of alpha relevant to different strategies and managers. This helps to maximise the probability that we will enhance the expected realised diversification across our portfolios.

Our concern with most portfolio optimisation solutions in the real-world is that they fail to account for a number of key fundamental features of hedge fund strategies including:

- Capacity – Some hedge fund strategies and managers are capacity constrained, limiting the amount of capital you can allocate efficiently. The pathways by which certain funds/managers are able to take capital are rarely continuous/linear, as such, it is often the case that investments into certain funds will be ‘lumpy’, dependent upon the underlying fund/manager’s willingness and ability to take new capital.

- Fee schedules / limited availability of favourable share-class terms – There may well also be time factors that incentivise earlier investment in a fund’s lifecycle (such as favourable fees for earlier investors). It may be optimal to allocate a greater proportion of capital earlier than one would otherwise do so if purely using a mean-variance based approach.

- Directionality – Hedge fund strategies can exhibit beta to traditional markets and factors. For example: the ‘optimal’ portfolio allocation from Aurum’s perspective is also a function of minimising or limiting exposure to such factors, however, other allocators are likely to have a different objective function and therefore a different ‘optimal’ portfolio allocation solution.

- Diversification – Some strategies offer a higher degree of intra-strategy diversification allowing for larger capital allocations. This topic is discussed in my work colleague Ana Johnson’s piece, ‘The Quest for the Holy Grail’.

- Relationships – Forging a strong positive relationship with specific hedge fund managers can provide early access to niche and capacity-constrained investment opportunities.

- Liquidity – The optimal portfolio could be difficult to implement in practice due to the illiquid nature of some strategies, intended cost to liquidate the portfolio, and each fund’s subscription/redemption terms.

- Leverage – Several highly leveraged hedge fund strategies exhibit extremely compelling risk-adjusted return characteristics, however, these strategies’ extensive use of leverage can result in fat-tail risks.

- Geographical exposure – Portfolio optimisation rarely balances for underlying position level geographical exposures.

It is important to note that while we take great pride in creating our proprietary database, there are several limitations and biases that can’t be avoided in this analysis. For example, self-selection bias occurs since not all hedge funds choose to report returns to Aurum, or one of our many data sources. Or backfill bias can occur when a hedge fund begins to report data to Aurum and our indices are adjusted accordingly; this typically happens with successful funds. You can read more about the various methodologies used to maintain indices and how they can impact analysis in our recent piece on this subject here.

Conclusion

This paper highlights the importance of correlation risk for portfolio construction and outlined some of the main benefits and limitations to using portfolio optimisation techniques. As experienced allocators, Aurum are cognisant of the risks of over-optimisation. We are not only optimising a few constraints (ie volatility and return), but also looking to optimise based on minimising drawdowns, minimising exposure to certain common ‘risk factors’ and also minimising exposure to strategies with ‘fat-tails’. This all has to be achieved in a real-world setting that takes into account all the fundamental hedge fund features mentioned above. Therefore, we believe that conducting deep qualitative analysis, supplemented with quantitative tools, has been a critical factor in enabling the Aurum funds to deliver long and successful track records through multiple market cycles.

Author: Ronak Thakrar. Ronak is based in London and is a Senior Research Analyst at Aurum Research Limited. All investment and trading decisions are made by Aurum Fund Management Ltd. which is based in Bermuda.

-

Source: Aurum Hedge Fund Data Engine database containing data on just under 4,000 hedge funds representing in excess of $2.9 trillion of assets as at December 2020. Information in the database is derived from multiple sources including Aurum’s own research, regulatory filings, public registers and other database providers.

-

Equal weighted approach gives the same weight to each strategy.

-

Equal risk weighted approach weigh each strategy in such a way that they each contribute equally to the risk of a portfolio.

-

Mean-variance optimisation is a statistical framework that allocates weights by considering a trade-off between risk and return.

-

Tactical asset allocation is a dynamic asset allocation strategy that shifts weights across asset classes over time.

-

For definitions on how the strategies and sub-strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/, and for information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/

-

A Monte Carlo simulation is a model used to predict the probability of different outcomes when the intervention of random variables is present.

-

Vikas Agarwal & Narayan Y Naik, Multi-Period Performance Persistence Analysis of Hedge Funds, 2000.

-

L.R Glosten & R. Jagannathan, A contingent claim approach to performance evaluation, 1994.

-

William Fung & David A. Hsieh, The Review of Financial Studies, 2001.

-

Mark Mitchell & Todd Pulvino, Characteristics of Risk and Return in Risk Arbitrage, 2001.

All figures and charts use asset weighted returns unless otherwise stated. All data is sourced from Aurum Hedge Fund Data Engine.

Disclaimer

This Post represents the views of the author and their own economic research and analysis. These views do not necessarily reflect the views of Aurum Fund Management Ltd. This Post does not constitute an offer to sell or a solicitation of an offer to buy or an endorsement of any interest in an Aurum Fund or any other fund, or an endorsement for any particular trade, trading strategy or market.

This Post is directed at persons having professional experience in matters relating to investments in unregulated collective investment schemes, and should only be used by such persons or investment professionals. Hedge Funds may employ trading methods which risk substantial or complete loss of any amounts invested. The value of your investment and the income you get may go down as well as up. Any performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable indicator of future results. Returns may also increase or decrease as a result of currency fluctuations. An investment such as those described in this Post should be regarded as speculative and should not be used as a complete investment programme.

This Post is for informational purposes only and not to be relied upon as investment, legal, tax, or financial advice. Whilst the information contained in this Post (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Aurum to be reliable, it is not guaranteed as to its accuracy or completeness. This Post is current only at the date it was first published and may no longer be true or complete when viewed by the reader. This Post is provided without obligation on the part of Aurum and its associated companies and on the understanding that any persons who acting upon it or changes their investment position in reliance on it does so entirely at their own risk. In no event will Aurum or any of its associated companies be liable to any person for any direct, indirect, special or consequential damages arising out of any use or reliance on this Post, even if Aurum is expressly advised of the possibility or likelihood of such damages.