Insights

Multi-strategy hedge fund primer: deep dive into diversification

In summary

Multi-strategy hedge funds seek to maximise risk-adjusted returns by investing in a variety of underlying investment strategies, or differing sub-strategies of the same master strategy. They often employ flexibility in terms of capital, aiming to allocate dynamically to the best opportunities and shifting resources to where they are most needed, or even staying away from certain strategies or assets altogether. They are often favoured by investors looking to achieve consistent returns across different market cycles. Scalability is another reason why multi-strategy funds are popular, particularly with larger allocators; more capital can be allocated to successful portfolio managers quickly and they have the ability to hire more managers to run similar portfolios. This scalability, that can lead to the creation of behemoths, is a handicap for some but an advantage for others. There is a significant size bias within multi-strategy, which is somewhat dominated by a small number of very large, established firms.

Multi-strategy funds stand out as having the highest proportion of returns attributable to alpha when looking at alpha/beta P&L decomposition analysis. It is also one of the master strategy groupings with the lowest volatility, largely due to the diversified nature of their investments. You can read more about this analysis in Aurum’s industry deep dives. Consequently, multi-strategy Sharpe ratio tends to be among the highest across the hedge fund industry, while maintaining among the lowest volatility. However, multi-strategy hedge funds are not a homogeneous group and they can vary enormously; adopting different business models, areas of focus, risk parameters, levels of concentration, liquidity requirements and fees. The size and complexity of multi-strategy hedge funds means that carrying out investment and operational due diligence requires significant experience and resources and is not for the faint hearted.

About Aurum

Aurum is an investment management firm focused on selecting hedge funds and managing fund of hedge fund portfolios for some of the world’s most sophisticated investors. Aurum also offers a range of single manager feeder funds.

Aurum’s portfolios are designed to grow and protect clients’ capital, while providing consistent uncorrelated returns. With 30 years of hedge fund investment experience, Aurum’s objective is to lower the barriers to entry enabling investors to access the world’s best hedge funds.

Aurum conducts extensive research and analysis on hedge funds and hedge fund industry trends. This research paper is designed to provide data and insights with the objective of helping investors to better understand hedge funds and their benefits.

Multi-strategy universe at a glance

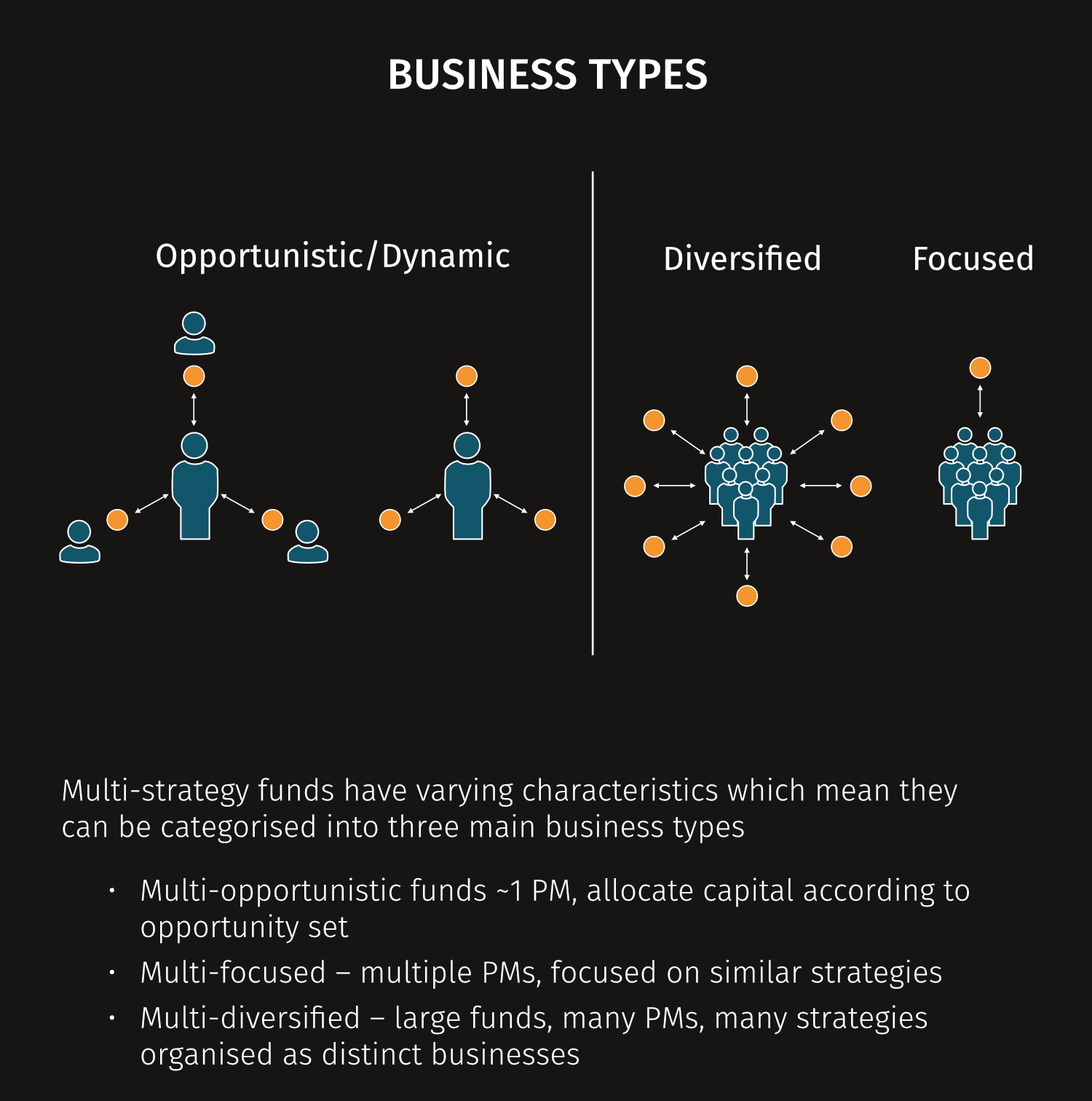

Categorising the multi-strategy universe – three types

Aurum tend to look at multi-strategy funds by three main business types with differing characteristics. These fund characterisations are fluid, and a fund can evolve over time and change from one category to another.

- Opportunistic/dynamic (“multi-opportunistic”)

- Multi PM – focused (“multi-focused”)

- Multi PM – diversified (“multi-diversified”)

OPPORTUNISTIC/DYNAMIC (“MULTI-OPPORTUNISTIC”)

Funds with just one or at most a handful of PMs that dynamically allocate capital to different strategies depending on where the best opportunities lie.

Funds with just one or at most a handful of PMs that dynamically allocate capital to different strategies depending on where the best opportunities lie. They can have just one PM who engages in different strategies opportunistically, or a CIO who allocates to sub-PMs or specialists who in turn run different strategies. The defining characteristic of this type of fund is that capital is dynamically moved around to the areas with the best opportunities and is underweighted or not deployed at all in strategies that are out of favour. These funds tend to have traditional fee structures with a management fee and performance fee. Usually, this results in PMs being compensated on the success of the business, rather than their individual performance. This model is well suited to cyclical strategies that tend to do well in different types of environments. The model suits PMs who enjoy collaboration and are happy to be compensated on the success of the firm rather than just their own performance. With different strategies driving performance at different times, PMs are not under pressure to deploy capital at times when the opportunity set for their strategy is not good, and they can get paid even through those lean periods. On the flip side, they may be undercompensated in a year when they personally do very well but the firm as a whole does not.

MULTI PM – FOCUSED (“MULTI-FOCUSED”)

Funds that have multiple-PMs running separate portfolios but generally deploying a similar strategy or focused on a more defined, narrower universe.

Funds that have multiple-PMs running separate portfolios but generally deploying a similar strategy or focused on a more defined, narrower universe. An equity platform fund would be such an example: i.e. many sector or geographic specialists running individual equity market neutral portfolios. While each portfolio consists of different stocks, they are all equity market neutral portfolios utilising the same strategy across a different subset of stocks. Another example would be a quant fund that invests across the spectrum of asset classes, styles, durations, and geographies. While this type of fund utilises many different strategies, all of them can be classified as quant. In a similar way you could have a multi strategy fund with multiple PMs focused on event driven strategies, or a fund that invests in many different strategies but only in one region, such as for example Asia focused. One could classify all of these types of funds as multi-focused.

MULTI PM – DIVERSIFIED (“MULTI-DIVERSIFIED”)

Usually very large funds that could have strategy groups organised as distinct businesses.

Usually very large funds that could have strategy groups organised as distinct businesses. Each of these businesses has its own management structure and underlying PMs, but the combination of these businesses forms the multi-strategy hedge fund. For example, a fund of this type could have separate equity long/short, credit, fixed income and macro, and arbitrage businesses. Each of these businesses would have multiple PMs and fund investors get exposure to all of them; or in some cases each of them could be a standalone hedge fund. Capital allocations are fairly stable across each of the businesses. On an individual PM level, capital allocations are likely determined by the risk team in conjunction with capacity considerations, and capital availability, rather than on the opportunity set. The manager may also make these strategies available to investors on a standalone basis.

These funds tend to utilise a passthrough fee structure, which ensures that individual teams get compensated for their respective performance irrespective of the overall firm performance.

This model of multi-diversified funds can be very scalable because firms can add portfolio managers running the same strategies, the same strategies in new regions or completely new strategies. They can grow to be deeper or grow to be wider.

RISK PARITY

Risk parity funds use risk to determine the allocation to the various PMs, strategies or business lines within a fund. There are some who would consider risk parity funds to be multi-strategy funds as they dynamically allocate across different asset classes. While these funds may be diversified across asset classes, Aurum does not consider them to be hedge fund strategies and such funds are not included in this analysis.

Table of characteristics

| Variable | Multi-opportunistic | Multi-focused | Multi-diversified |

|---|---|---|---|

| PMs | One or small number | Multiple PMs | Multiple PMs |

| Collaborative | Very collaborative | Independent pods – may be limited inter-pod collaboration | Independent pods – may be collaboration between strategy heads |

| Fees | Traditional management and performance fee | Mostly pass through but can be traditional in some cases | Pass through |

| Capital allocation | Dynamic | Less frequent | Less frequent |

| Ability to size up positions, or tilt portfolio | Through dynamic capital allocation | Through centre book | Through centre book |

| Leverage | Low | High | Highest |

| Liquidity | Variable (strategy dependent) | Variable (strategy dependent) | Variable (strategy dependent) |

| Management structure | CIO model | CIO and risk management model | Business heads, committees and multiple layers of management and risk oversight |

| PM compensation | Based on business success | Based on individual performance | Based on individual performance |

| Size | Small to large (broad range) | Medium to large i.e. < $1bn | Large to very large i.e. $5bn+ |

| Employees | < 100 people | 100-1,000 people | 1,000+ people |

| Offices | Usually one office, but may have regional | Hub and regional | Global reach with multiple hubs |

| Risk | CRO or CIO who oversees risk | CRO and risk team | Multiple layers of risk management with large risk team |

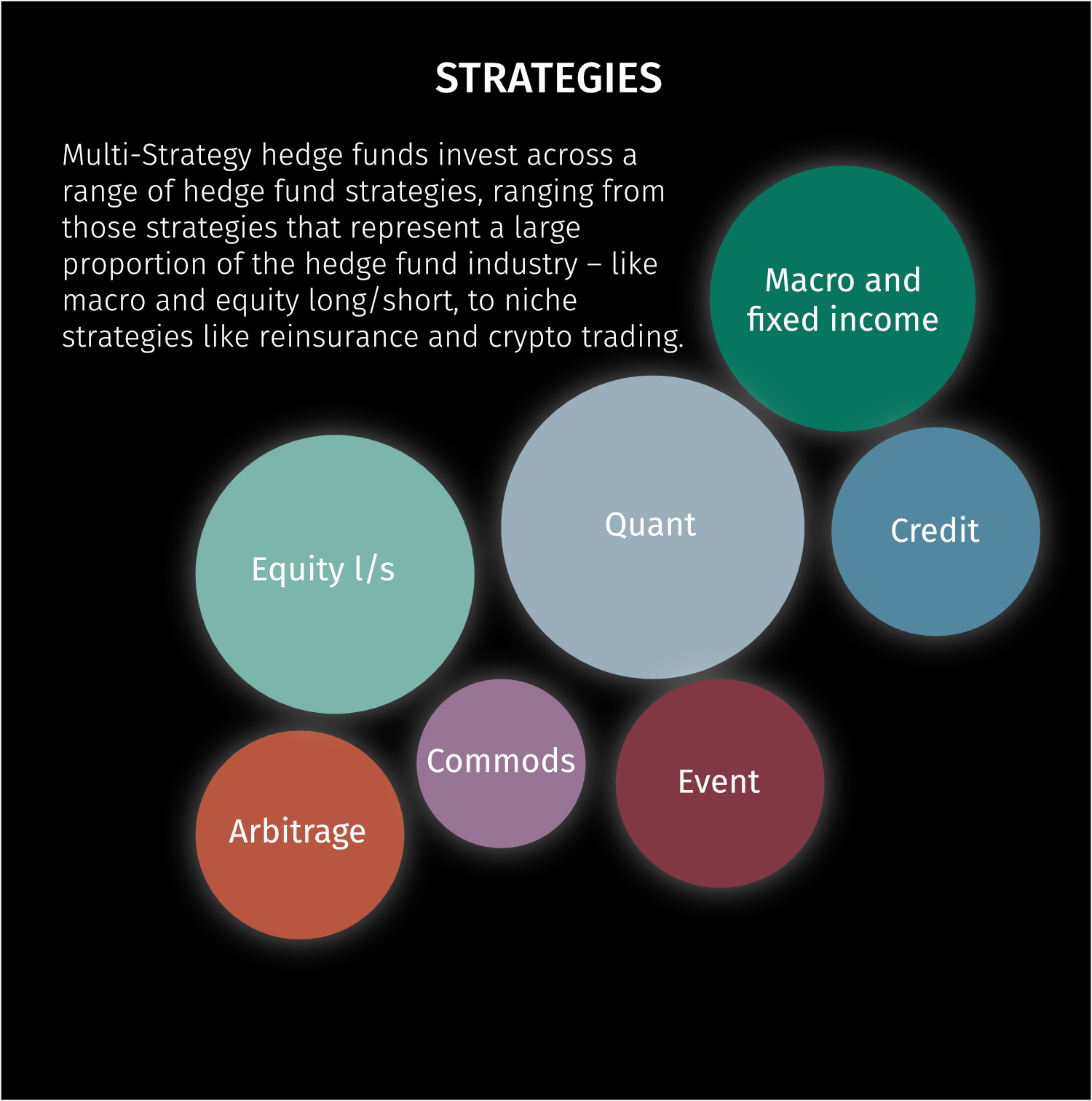

Strategies deployed

Multi-strategy hedge funds invest across a number of hedge fund strategies, most notably:

MACRO AND FIXED INCOME

Macro funds take positions (can be either directional or relative value) in currencies, bonds, equities and commodities, based on fundamental and qualitative judgements. Investment decisions can be based on a manager’s top-down views of the world (e.g. views on economy, interest rates, inflation, government policy or geopolitical factors). More on macro sub strategies can be found here or in our recently published macro primer.

EQUITY LONG/SHORT AND FUNDAMENTAL EQUITY MARKET NEUTRAL

Investing in global stocks, both on the long and short side. Most funds have a fundamental bias, value and/or growth-oriented investment theses are typically adopted. More on equity long/short sub strategies can be found here.

CREDIT

Strategies that focus the vast majority of their trading on debt instruments, or instruments that are far more ‘debt-like’ in nature. More on credit sub strategies can be found here.

EVENT DRIVEN

Broad strategy category covering funds that invest in securities of companies facing announced and anticipated corporate events. More on event driven sub strategies can be found here.

QUANT

Systematic strategies: Funds trade securities based strictly on the buy/sell decisions of computer algorithms. More on quant sub strategies can be found here or in our recently published quant primer.

COMMODITY

These funds are primarily focused on trading commodity futures and options from both the long and short side. They can occasionally include the tactical use of equities, currencies, or fixed income instruments, but commodity futures/options should make up the bulk of the risk. The manager is typically looking for longer term trends and supply/demand imbalances within and between commodity markets. Funds tend to either focus on a specific area within commodities, such as energy, metals, agricultural commodities etc, or a diversified mix across the commodity spectrum.

ARBITRAGE

Strategies that look to benefit from mispricings of the same instrument/asset or extremely closely related instrument. More on arbitrage sub strategies can be found here.

OTHER

There are certain niche or orthogonal strategies that do not fit within any of the above categories. Examples of these are: reinsurance, appraisal rights, trade finance and crypto trading.

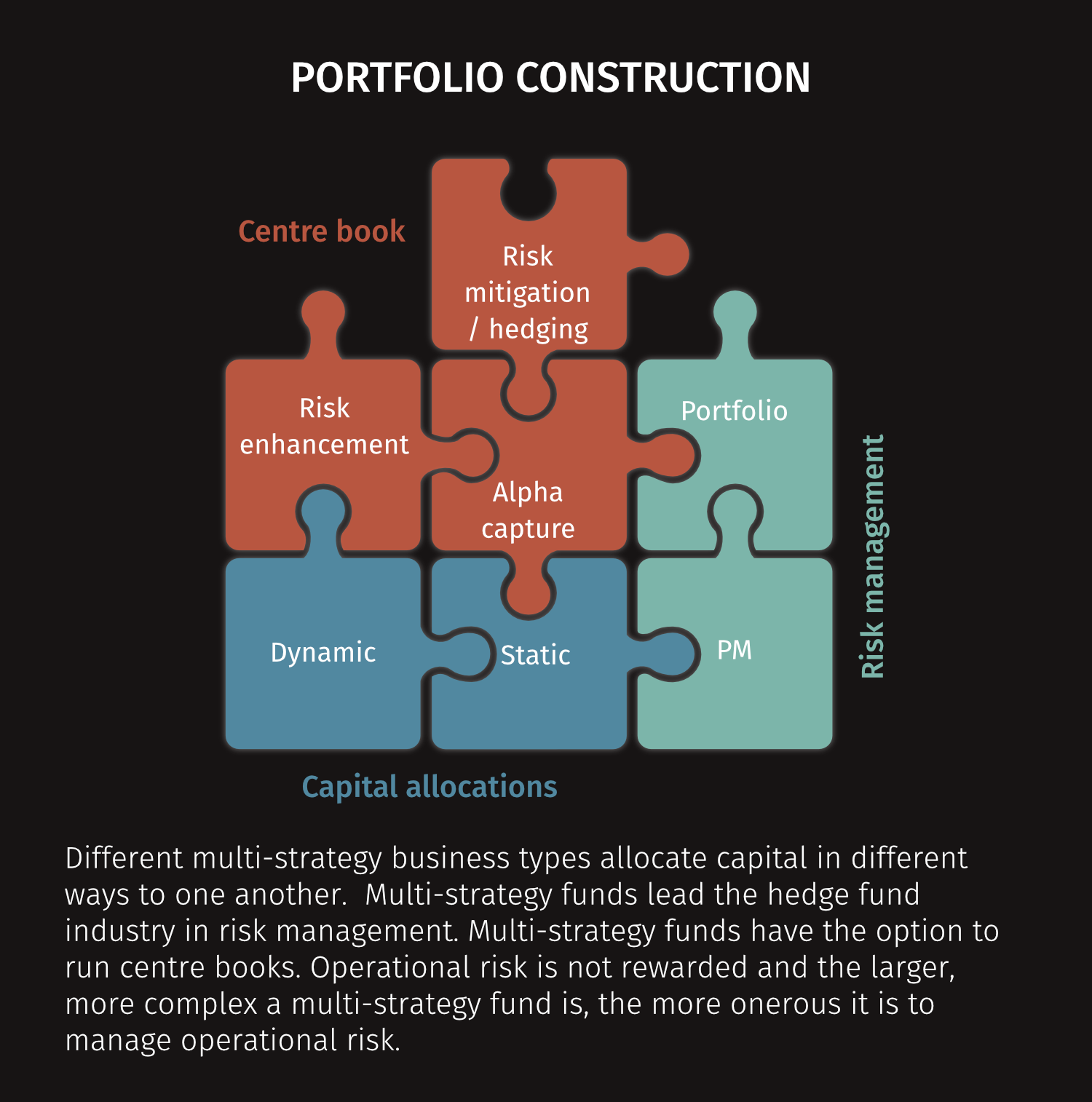

Portfolio construction

CAPITAL ALLOCATIONS

Capital allocations are a function of how much capital the fund has and how much capital its portfolio managers are capable of running. Assuming the fund is in high demand and can raise capital at will, then capital allocations to PMs are determined by how much money these PMs were running previously. It is scaled up as they scale their teams and build more capacity. If PMs are struggling to deploy capital or are running low utilisation rates, their capital allocation may be reduced. Likewise, capital may be cut from poorly performing PMs. This differs somewhat in multi-opportunistic funds, which allocate capital dynamically depending on the opportunity set, so capital allocations are much more fluid.

CENTRE BOOK

Centre books, which are systematically driven or run by senior management and sit “on top” of PMs’ books are used to either enhance risk across the whole portfolio, oversize specific positions, or mitigate risk through hedging.

Multi-strategy hedge funds have the option to run centre books. Centre books, which are systematically driven or run by senior management and sit “on top” of PMs’ books are used to either enhance risk across the whole portfolio, oversize specific positions, or mitigate risk through hedging. The simplest form of a centre book is a replication book. The purpose of a replication book is to utilise higher leverage with exactly the same positions. A more sophisticated way to enhance risk is to use alpha capture techniques, using existing and historical data from PM portfolios and trades to run a systematic book that produces independent alpha. In a similar manner, a CIO could use the centre book to take additional risk in specific trades. While a multi-opportunistic fund may guide capital to where the best opportunities lie, the centre book in a multi-diversified fund could play the same role, by enhancing risk in specific areas without necessarily having to reduce risk in others. Finally, a centre book can be used to hedge unwanted risks that may arise at an aggregated level for the firm; rather than going to individual PMs and asking them to adjust their portfolios, this adjustment can be done at a firm level.

Replication books have the advantage that they can be used to very quickly enhance or reduce risk at a firmwide level without pushing PMs themselves to do it. Another advantage of using a centre book to enhance risk is that it is cheaper, because performance generated is not necessarily attributed to any individual PMs and thus no incentive needs to be paid; this is a particularly helpful tool to reduce the cost in pass-through fee funds. A centre book used for hedging is useful because it allows PMs to run their books without interference and instructions to change positioning because other PMs at the firm may have similar positions in their books. In general, centre books allow firms to make adjustments without interfering with individual PM books and they reduce cost.

RISK MANAGEMENT

Multi-strategy funds tend to have the largest and most sophisticated risk management systems in the hedge fund industry. This is because they have to deal with risks in individual portfolios across many asset classes and instruments both at an individual portfolio level as well as at an aggregated firmwide portfolio level.

Generally, risk management is applied at two levels, at PM level and at portfolio level. At the PM level PMs and the risk team typically agree a set of parameters to which the PM must adhere. These may include the assets they are allowed to trade, buying power, their gross and net exposure, concentration limits, factor exposures, VaR usage, volatility targets etc. They may also agree P&L limits whereby PMs have to cut risk at certain levels and may also agree loss levels at which their contracts would be terminated. Some firms have a culture of leaving PMs alone as long as they adhere to their agreed parameters, while in others the risk team may work closely with the PMs in a supporting role to mitigate unwanted risks, or even enhance risk in some cases.

Generally, risk management is applied at two levels, at PM level and at portfolio level.

Risk is also managed on an aggregated portfolio level. Multi-strategy funds with many PMs trading across similar domains may have similar positions that in aggregate expose the fund to unwanted risks, even though the individual portfolio managers remain within their individual sets of parameters. Risk teams monitor various metrics such as leverage, unencumbered cash, VaR, DV01, CS01, gross and net exposures and perform stress tests on the portfolio, both historical and simulated scenarios. Risk team’s have the ability to intervene at individual portfolio level, across all portfolios, or through centre/hedging books. Like individual portfolios, they may use specific drawdown triggers at which they start to reduce risk.

OPERATIONAL RISK

While this primer is focused on the investment case for multi-strategy hedge funds, there is also an important operational aspect. Like all hedge funds, operational risk is something that needs to be mitigated. There is no reward for operational risk.

There is no reward for operational risk.

Operational risk management at multi-strategy funds is complex and costly. Multi-strategy funds generally have multiple prime brokers and ISDA counterparties. This necessitates the design of systems, infrastructure and trading facilities to deal in many different instruments. A feature of multi-strategy funds’ operations is that they ringfence different strategies by segregating them into separate entities. Multi-strategy funds have substantial middle and back-office resource requirements. Compliance is especially important as they have oversight over many different people and entities which are trading.

Structure

MANAGEMENT STRUCTURE

Variation in management structures tends to be a function of fund size. Smaller funds tend to be run by their owner or a small group of partners, while larger firms tend to have more complex management structures with multiple layers and dimensions. Large diversified multi-strats tend to have standalone businesses for each strategy with their own self sufficient management structures. In a similar manner, they may be organised geographically, with a management structure for each region/ office location. These funds tend to have strategy heads, middle management, business development people, execution traders and risk professionals, relying on the parent firm for operational support.

INTERNAL VERSUS EXTERNAL PM TEAMS

The traditional multi-strategy model historically relied on all its people being employees of the firm and working from the firm’s offices. As successful teams at these multi-strategy firms eventually spun out and formed their own firms, their previous employer was able to maintain an investment in those PMs through SMAs in their new funds; that way they were able to continue to have exposure to those PMs while retaining the assets under their control through the SMA. Using this same structure, some multi-strategy funds were able to invest in external managers by investing in their existing firms through SMAs. This allows the PMs to have their independence, operate from their own office space and have other clients in parallel to the multi-strat. Some multi-strats operate entirely on that premise, with quite lean operations internally and portfolio managers and teams that sit externally. This is a hybrid structure combining aspects of a fund of funds and a multi-strat hedge fund aiming to maximise the best of each model.

CULTURE/COLLABORATION

Collaboration is one of the defining characteristics of a firm’s culture. Some firms outright discourage collaboration because they want to avoid group think; others encourage collaboration because it leads to shared resources and the belief that more can be achieved though sharing of information and striving towards a common goal.

As a general rule, firms with traditional fee structures where PMs are rewarded on the success of the business, rather than their own performance, tend to be more collaborative, because their primary objective to maximise returns for the firm. Within larger multi-strategy platform funds, however, PMs operate more independently, because they are rewarded purely on their own performance. They tend to be more competitive and are less inclined to collaborate with their peers who they see as competitors. From a firmwide perspective, however, there are benefits to collaboration, so this tends to be encouraged at a higher level; for example, there may not be much collaboration between individual equity PMs, but sector heads, or business heads will meet on a regular basis to exchange views/insights/ideas. Insights obtained by one group may be useful to another group, i.e. the views of a macro economist in the fixed income business, may be useful to a consumer equity PM who is building models with future projections.

In summary, firm principals generally want to encourage collaboration that will lead to better results for the firm as a whole, but prefer to keep PMs doing very similar things siloed from each other in order to avoid group think.

SIZE AND SCALING

While there are exceptions, multi-diversified funds tend to be larger than multi-focused funds which tend to be larger than multi-opportunistic funds, particularly when it comes to employee count and more often than not, assets under management; but that is not to say that there are some very large multi-opportunistic funds and some relatively smaller multi-diversified funds.

Funds with multiple offices tend to employ more people as duplicate roles are needed in each office; such as compliance, trade execution and operational support.

Multi-opportunistic are difficult to scale beyond a certain point, because by adding more strategies, it becomes more difficult to allocate dynamically between them. Also, if one were to build large capabilities and infrastructure spend for one particular strategy, there would be a large unutilised resource when capital is not deployed in that strategy. In addition, in order to preserve their collaborative culture, they need to maintain a team size that is manageable. For this reason, multi-strategy opportunistic funds tend to be relatively lean in each strategy and use centralised shared resources as much as possible and do not have huge headcounts. They do benefit, however, from being able to operate within a wider AUM range without meaningful change in their resources. A fund with a breakeven AUM of $500m and capacity of $2bn could operate anywhere within that range with the same resources.

Multi-diversified are the most scalable multi-strats, but also have a narrow band when it comes to optimal AUM they can manage. If they have too much money, they are under-levered and returns become diluted. If they don’t have enough capital, their cost burden is too high and they face PM retention risk because of their reduced buying power.

In order not to dilute returns, they need to build capacity in conjunction with AUM growth and conversely need to cut resources when AUM declines. Capacity is created by adding PMs to existing strategies, or expanding to more strategies, asset classes and geographic regions. In other words, they can become deeper, or wider, or both.

The conundrum for these firms is that in order to grow, they need more capital. If they get more capital they have to grow to utilise that capital. The question is – which comes first?

- AUM growth without PM growth = dilution of returns

- No AUM growth = Inability to increase allocations to successful PMs leading to retention risk

Growth can be beneficial, but also very challenging for multi-strategy hedge funds. As they grow and expand their investment capabilities they also need to invest in infrastructure and operational support, which is a costly exercise and one that is difficult to reverse. It is a fine balancing act between raising capital and growing investment capabilities.

There are a handful of very successful multi-strategy hedge funds that are closed and have a waiting list of investors who want to add capital. These firms have the luxury of pacing their growth. They can hire new teams and build operational infrastructure with the confidence that they can in parallel raise more capital from investors; and if they feel they are running too much capital they simply return capital to investors. One may ask why would a fund ever return capital? Particularly for funds with passthrough fees, the principals are rewarded through performance, and not AUM growth because they do not generally charge fixed management fees. If asset growth dilutes returns, this eats into the principals’ profit, so they are more inclined to want to run at an optimal size, and not get too big. In reality, however, there are very few firms that are in such a strong position of being able to raise or to return capital at will. Most firms actively seek to raise capital in order to facilitate their growth, or use their pass through expense model to finance the infrastructure spend that will facilitate growth and create additional capacity. Many raise the capital before they have the ability to deploy it, while others build out the infrastructure, but can’t raise enough capital to support their investment and the increased cost burden eats into returns.

This is why many believe the best path to grow is to do it iteratively step by step without diluting returns while at the same time not over-extending themselves.

HIRING TALENT

Multi-strategy funds with pass through fees have the ability to offer the most competitive pay packages to both operational staff, as well as those PMs whose compensation is linked to their performance. A multi-strategy hedge fund is an attractive place for talented PMs to work. They are provided with sizeable capital allocations, good infrastructure, trading and operational support and compensation linked directly to their performance, irrespective of how the rest of the firm fares. They do not have the distractions that come with running their own business and having to deal with clients; yet their compensation is equal, or higher to what they would earn if they had their own firm.

More recently, hedge funds have been willing to buy people’s deferred compensation to reward them for the opportunity cost of sitting out for a period as they leave one employer and join another. Despite being portrayed by the media as ‘up-front bonuses;’, these payments are actually intended to compensate people for what they are leaving on the table by moving from one firm to another. The additional compensation is usually structured as an “accelerator”, whereby the PMs gets paid a higher incentive in the early years of their employment, but they have to be successful to earn it; it is not automatic and guaranteed.

Funds without pass-through fees cannot compete in bidding wars for talent and often lose some of their existing people to the pass-through funds. For this reason, they look for other ways to attract and retain talent. They offer incentives such as a path to partnership, shadow equity, ownership stakes, or the ability to spin out and run their strategy as a standalone fund.

Other incentives multi-strategy funds use to attract people are their firm culture (i.e. a collaborative versus siloed work environment), the size of a potential allocation, risk systems and support, access to resources and data, choice of location, flexibility, independence (having own firm and investing through SMA) and even participation in set up cost to launch an independent hedge fund.

With the cost of acquiring talent constantly going up, some firms look to hire young people in the early stage of the career (possibly straight out of college) and have built academies to train and develop these people internally. Others, however, take the view that it is too expensive to train people internally and then potentially lose them to a competitor who will pay them more. These firms would rather someone else trains them and are willing to a premium for the finished product.

Multi-strategy firms, and in particular the very large ones have large business development teams that source and track industry talent; similar to a very sophisticated internal group of head-hunters. This is particularly important as personnel turnover is high in hedge funds and in particular in risk taking roles where it is typical to have turnover rates of 10-20% and sometimes even higher.

HIGH BARRIERS TO ENTRY

The multi-strat model is popular and well tested and many are trying to emulate it. Barriers to entry, particularly in setting up a multi-diversified fund, are high. For a start-up multi-strat, it is difficult to compete with existing multi-strategy hedge funds for the best talent; and building the required infrastructure is exceedingly expensive.

Terms

FEES

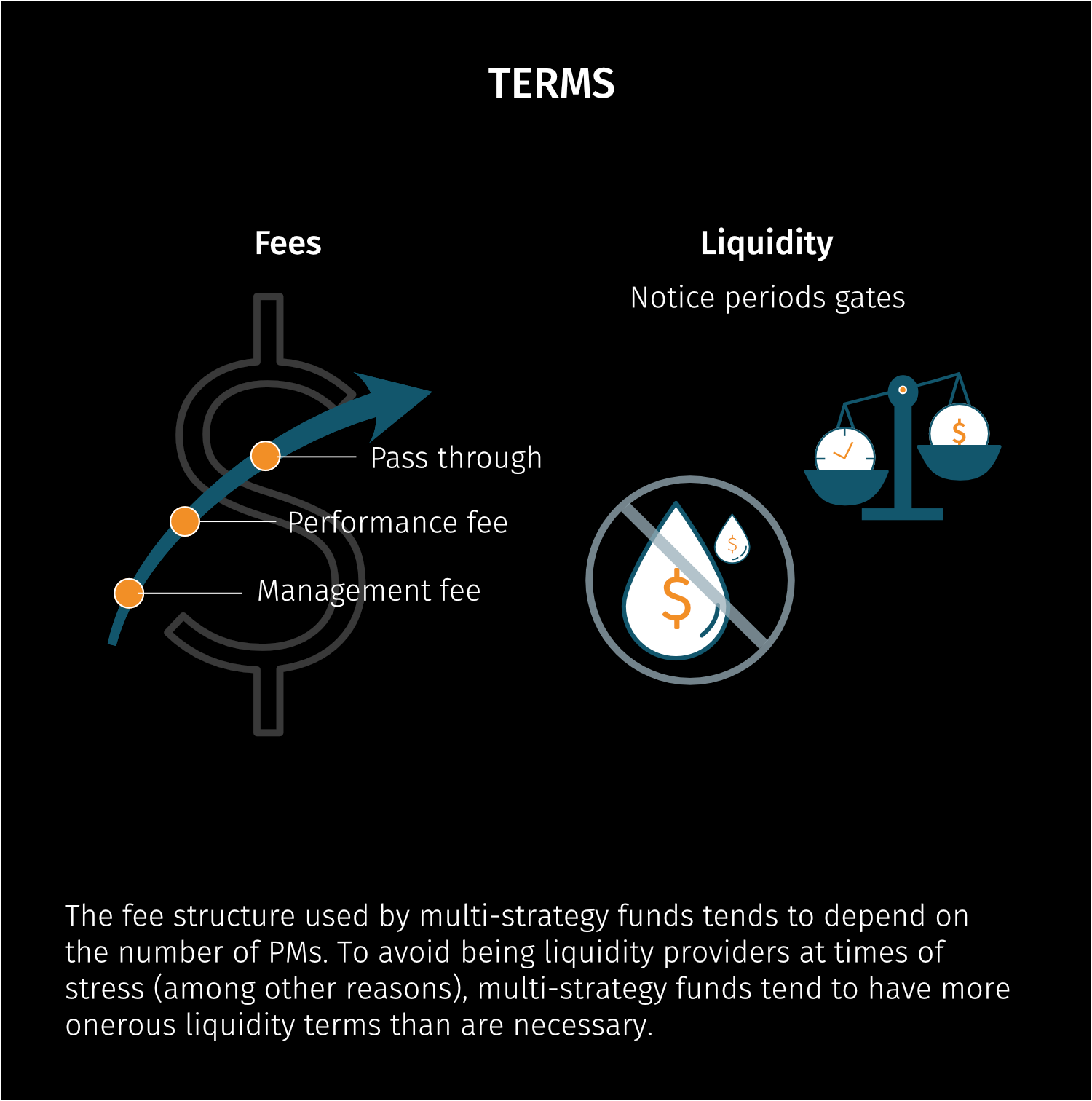

The fee structure used by multi-strategy funds tends to depend on the number of PMs.

The fee structure used by multi-strategy funds tends to depend on the number of PMs. Single PM multi-strats or multi strats with only a few PMs tend to use traditional management and performance fee structure as their businesses are cheaper to run and netting cost is low. Above a certain number of PMs, firms tend to opt for a passthrough fee structure where netting is borne by the end investor rather than the management company. This puts them in a strong position to attract some of the best talent available as they can offer prospective PMs guaranteed payouts directly linked to their performance. It also allows them to be more aggressive with leverage as netting cost is less of a concern and they are willing to take more risk. There are some multi-PM funds that use traditional fee structures where the netting is borne by the management company; however, in order for the model to work, they may have a higher management or performance fee, or the fund is run with lower risk/leverage.

LIQUIDITY

Liquidity of the underlying investment assets is a function of the strategies traded. The terms of the multi-strategy funds, however, are dictated by those firms rather than the liquidity they need to realise their portfolios. Multi-strategy funds are levered investment vehicles where management seek stability of capital. As such, to avoid being liquidity providers at times of stress they tend to have more onerous terms than are necessary.

Multi-strategy funds are levered investment vehicles where management seek stability of capital. As such, to avoid being liquidity providers at times of stress they tend to have more onerous terms than are necessary.

Fund and investor level gates are there to ensure that capital does not flow out at an uncontrollable pace forcing the fund to de-lever at a time when the opportunity set might be at its best. There is no set formula here – funds dictate their terms depending on what they can get away with, with higher quality funds with the most demand tending to have the most onerous terms. While this is counter intuitive, investors are of course most likely to redeem their least liquid assets first at a time of stress (particularly if they are open and they could potentially re-invest), while maintaining their most liquid holdings, particularly if they are closed and cannot add back into them.

Funds that have had mediocre performance get a false sense of security from having onerous redemption terms. Investors who are disappointed by their performance will redeem from them no matter what the terms; and while it may take longer to get out completely, they may start the process earlier because they know it will take longer. If the terms are more liquid, investors have the luxury to wait longer.

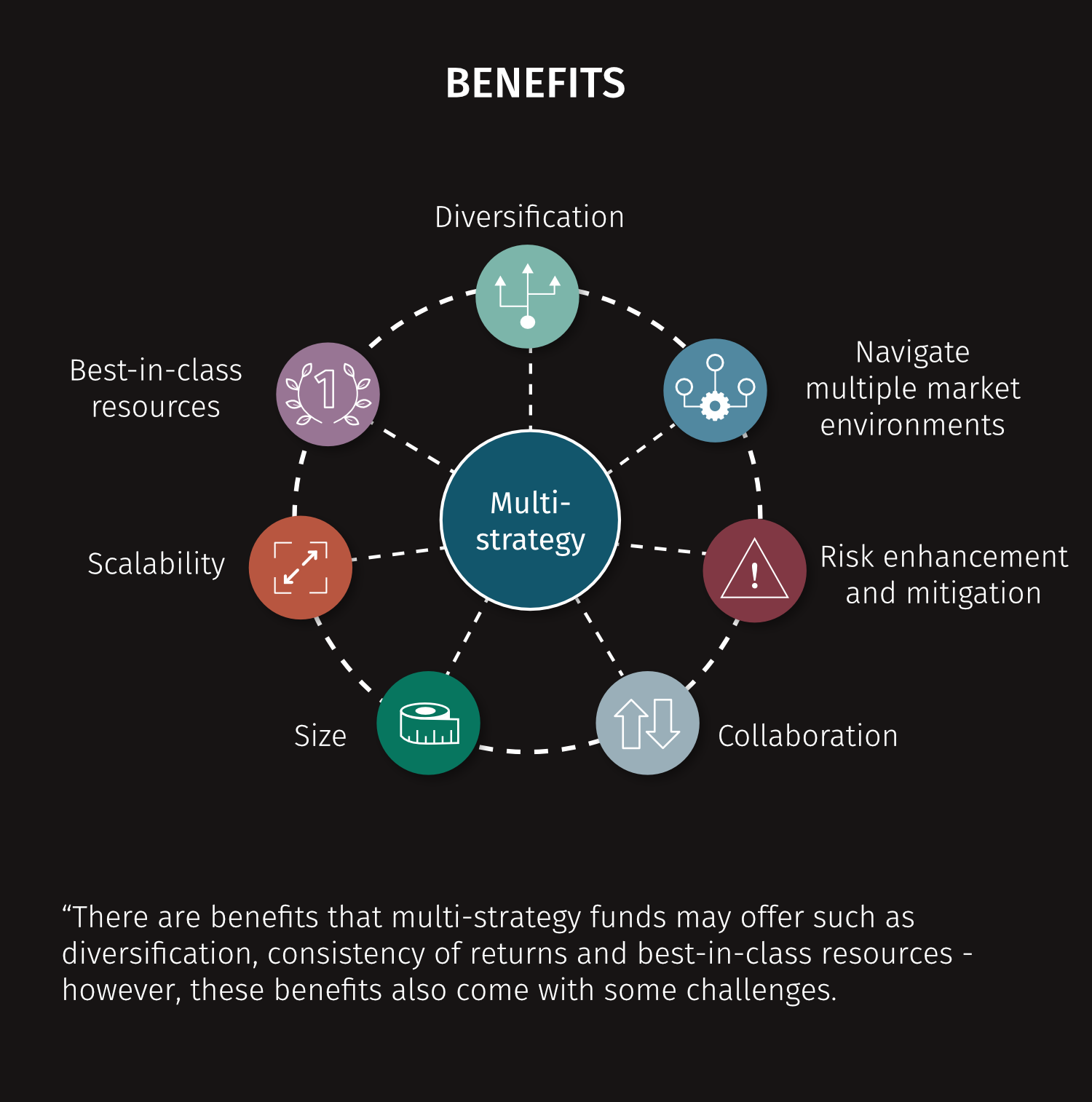

Benefits

There are many benefits to multi-strategy funds, however, these also come with some challenges. Some of the most noteworthy benefits are:

DIVERSIFICATION

Multi-strats are diversified by combining many risk takers deploying capital in different strategies, styles, asset classes and geographies. They are less dependent on any one particular person and can continue to function well despite high turnover of personnel.

CONSISTENT RETURNS IN ALL MARKET ENVIRONMENTS

Multi-strats have many different return drivers and can generate returns in most market environments. Their vulnerability, however, is to systemic shocks when everything becomes correlated and there is simultaneously mass deleveraging.

COLLABORATION

By having a footprint in many different markets and asset classes, they have broader insights into all financial markets and can benefit from their teams collaborating. They can use these insights to oversize position, or tilt their exposure to markets, asset classes and strategies with the best opportunities.

SIZE

As a consequence of their larger size, they enjoy economies of scale and have superior infrastructure, sophisticated risk management systems, treasury functions and have more clout with their counterparties. They also have the ability to net off positions significantly cutting transaction costs.

SCALABILITY

They are scalable because they can grow by PM count, or by expanding into more strategies, asset classes or geographies. There are also challenges to growth however, such as moving into areas with lower levels of expertise, or not building the operational infrastructure required at the same pace as the investment universe expansion.

BEST-IN-CLASS RESOURCES

Multi-strats with pass-through fee structures can attract some of the best talent available by being able to offer them competitive pay packages, sizeable capital allocations and best in class infrastructure to trade. They also have the luxury that they can pass netting costs to investors rather than have to cover netting at the management company level; as a result they are willing to take higher levels of risk than they would otherwise.

RISK ENHANCEMENT AND MITIGATION

Multi-strats have sophisticated risk management frameworks and infrastructure. They are well suited to using leverage and can mitigate risk by hedging at the aggregated portfolio level.

For the latest multi-strategy performance and strategy chart packs, click here.

*The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Data from the Hedge Fund Data Engine is provided on the following basis: (1) Hedge Fund Data Engine data is provided for informational purposes only; (2) information and data included in the Hedge Fund Data Engine are obtained from various third party sources including Aurum’s own research, regulatory filings, public registers and other data providers and are provided on an “as is” basis; (3) Aurum does not perform any audit or verify the information provided by third parties; (4) Aurum is not responsible for and does not warrant the correctness, accuracy, or reliability of the data in the Hedge Fund Data Engine; (5) any constituents and data points in the Hedge Fund Data Engine may be removed at any time; (6) the completeness of the data may vary in the Hedge Fund Data Engine; (7) Aurum does not warrant that the data in the Hedge Fund Data Engine will be free from any errors, omissions or inaccuracies; (8) the information in the Hedge Fund Data Engine does not constitute an offer or a recommendation to buy or sell any security or financial product or vehicle whatsoever or any type of tax or investment advice or recommendation; (9) past performance is no indication of future results; and (10) Aurum reserves the right to change its Hedge Fund Data Engine methodology at any time and may elect to supress or change underlying data should it be considered optimal for representation and/or accuracy.

Disclaimer

This Post represents the views of the author and their own economic research and analysis. These views do not necessarily reflect the views of Aurum Fund Management Ltd. This Post does not constitute an offer to sell or a solicitation of an offer to buy or an endorsement of any interest in an Aurum Fund or any other fund, or an endorsement for any particular trade, trading strategy or market. This Post is directed at persons having professional experience in matters relating to investments in unregulated collective investment schemes, and should only be used by such persons or investment professionals. Hedge Funds may employ trading methods which risk substantial or complete loss of any amounts invested. The value of your investment and the income you get may go down as well as up. Any performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable indicator of future results. Returns may also increase or decrease as a result of currency fluctuations. An investment such as those described in this Post should be regarded as speculative and should not be used as a complete investment programme. This Post is for informational purposes only and not to be relied upon as investment, legal, tax, or financial advice. Whilst the information contained in this Post (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Aurum to be reliable, it is not guaranteed as to its accuracy or completeness. This Post is current only at the date it was first published and may no longer be true or complete when viewed by the reader. This Post is provided without obligation on the part of Aurum and its associated companies and on the understanding that any persons who acting upon it or changes their investment position in reliance on it does so entirely at their own risk. In no event will Aurum or any of its associated companies be liable to any person for any direct, indirect, special or consequential damages arising out of any use or reliance on this Post, even if Aurum is expressly advised of the possibility or likelihood of such damages.