Insights

Macro hedge fund primer: uncovering the unconstrained

In summary

Macro funds typically take positions (either directional or relative value) in currencies, bonds, equities and commodities, based on fundamental and qualitative judgements. Investment decisions are usually based on a manager’s top-down economic and political views, such as views on economic growth, interest rates, inflation, government policy, and geopolitics. Relative valuations of financial instruments within or between asset classes can also play a role in the investment process. In this article we explore macro trading and provide insights into the most common macro strategies. For each macro strategy, we provide a description and sample trades and consider how the strategy has historically performed in different markets.

Macro managers are inclined toward tactical risk-taking, favouring dynamic portfolio adjustments as situations change.

About Aurum

Aurum is an investment management firm focused on selecting hedge funds and managing fund of hedge fund portfolios for some of the world’s most sophisticated investors. Aurum also offers a range of single manager feeder funds.

Aurum’s portfolios are designed to grow and protect clients’ capital, while providing consistent uncorrelated returns. With 30 years of hedge fund investment experience, Aurum’s objective is to lower the barriers to entry enabling investors to access the world’s best hedge funds.

Aurum conducts extensive research and analysis on hedge funds and hedge fund industry trends. This research paper is designed to provide data and insights with the objective of helping investors to better understand hedge funds and their benefits.

What are macro hedge funds?

Macro hedge funds focus on trading asset classes that are predominantly driven by macroeconomic factors, particularly fixed income and, to a lesser extent, currencies, and commodities. Macro funds tend to be less active in equities and credit, due to the significant impact of bottom-up factors on these asset classes. However, macro managers are often willing to express top-down views on equities and credit through aggregated securities, such as index futures and credit default swaps.

Macro managers are inclined toward tactical risk-taking, favouring dynamic portfolio adjustments as situations change. As such, practitioners place a high value on the liquidity of securities traded, resulting in a primary focus on developed markets, except for the subset of funds specialising in emerging markets. The strategy is also characterised by substantial use of derivative products—such as futures, options, and swaps—owing to the advanced state of derivative markets for primary macro asset classes. The appeal of derivatives extends to their embedded leverage and optionality.

Macro trades can be directional or relative value. While quantitative tools and analysis increasingly inform trades, risk-taking is discretionary. The time horizon of trades typically ranges from days to months. Trading over shorter time horizons has largely been ceded to quantitative funds, as macro managers struggled to compete over short time frames as quantitative strategies became more sophisticated in the 2010s.

Most common macro strategies

Macro funds can be categorised in various ways; however, the sub-strategy classifications used in this article align with those employed by Aurum’s Hedge Fund Data Engine, as follows:

- global macro

- fixed income relative value

- macro emerging markets, and

- commodities.

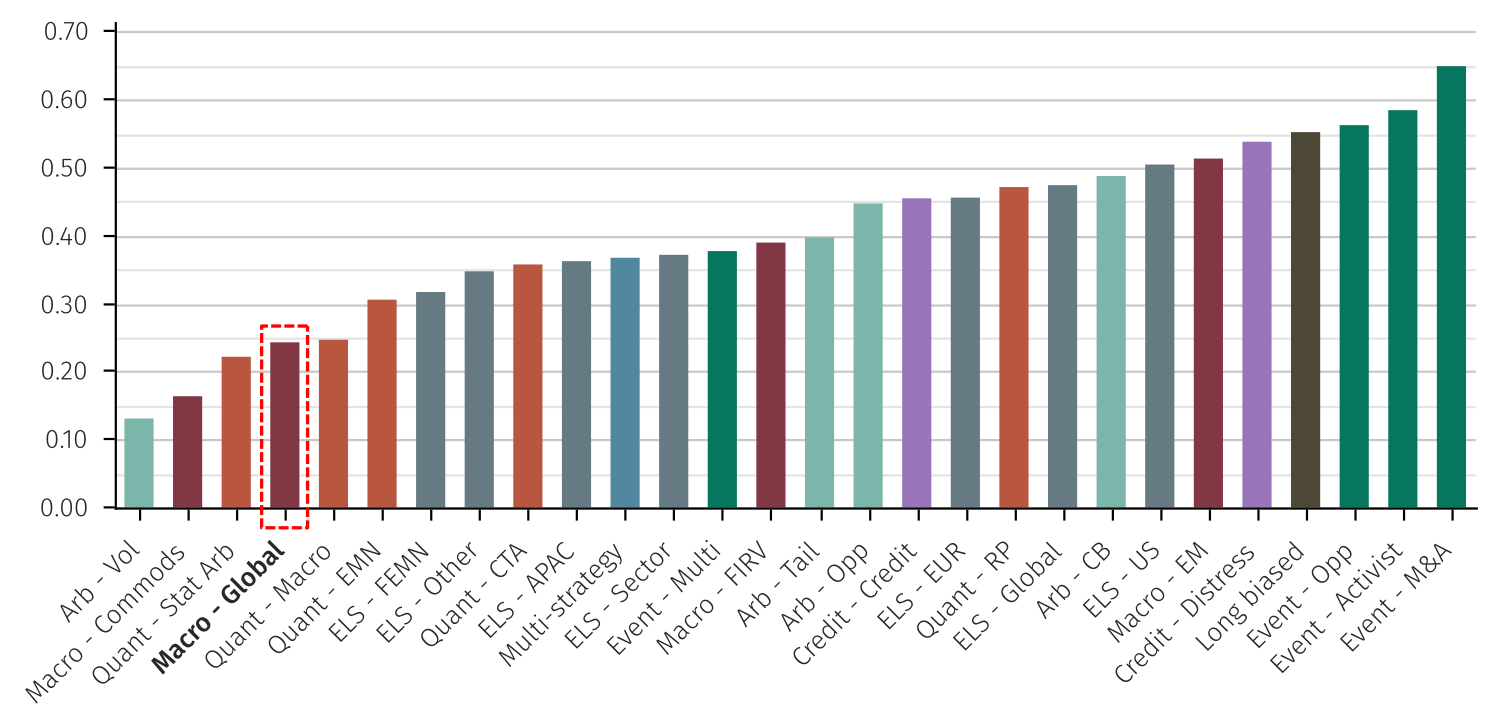

Global macro funds are generalist macro funds, while the other three sub-categories specialise in trading particular markets, specifically fixed income, emerging markets, and commodities. Global macro is the largest sub-strategy, representing over half of assets within macro, according to Aurum’s Hedge Fund Data Engine. The next largest strategy group is fixed income relative value, representing close to a quarter of assets, followed by macro emerging markets, representing around a fifth of assets, and commodities, the smallest sub-strategy by some way.

Aurum’s Hedge Fund Data Engine also tracks the performance of quant macro/global asset allocation (“GAA”) funds, however these are categorised as a sub-strategy within the quant master strategy. You can read more about quant macro/GAA in our recently-published Quant hedge fund primer: demystifying quantitative strategies.

Risk return summary

| Global macro | Fixed income relative value | Macro emerging markets | Commodities | |

|---|---|---|---|---|

| Typical assets traded | Fixed income, currencies, commodities; aggregated securities for equities and credit; related derivatives | Government bonds and related derivatives, such as fixed income futures, options, and swaps | Emerging market fixed income, currencies, and equities; commodities; ordered from most to least actively traded; related derivatives | Commodity derivatives, such as futures and options; material and energy equities; physical commodities; ordered from most to least actively traded |

| Directional or relative value bias | Combination between directional and relative value trades, with ‘old school macro’ favouring the former and ‘new macro’ favouring the latter | Relative value | Predominantly directional | Combination between directional and relative value trades |

| Long/short bias | None | None | Typically long-biased, particularly with respect to fixed income | None, with the exception of funds managed with a long bias or ‘long or out’ approach |

| Observed beta to traditional risk assets | Low (over medium term time horizons), with global macro funds often excelling during periods of market stress | Low | Medium to high | Low to medium (over medium term time horizons) |

| Historical volatility relative to other hedge fund strategies | Below average | Below average (among the lowest), although with some significant tail risks | Above average (among the highest) | Above average |

| Liquidity of underlying securities typically traded | High | High | Lower than global macro, particularly in global risk-off periods | Variable, dependent on the underlying commodity and specific contract traded, as well as the level of assets deployed |

| Typical leverage | Medium to high, dependent on the mix between directional and relative value trades | Very high | Low to medium | Low to medium, dependent on the mix between directional and relative value trades |

Global macro

DESCRIPTION

SAMPLE TRADE

PERFORMANCE IN DIFFERENT MARKETS

RISK/RETURN PROFILE

Fixed income relative value (“FIRV”)

DESCRIPTION

SAMPLE TRADE

PERFORMANCE IN DIFFERENT MARKETS

RISK/RETURN PROFILE

Macro emerging markets

DESCRIPTION

SAMPLE TRADE

PERFORMANCE IN DIFFERENT MARKETS

RISK/RETURN PROFILE

Commodities

DESCRIPTION

SAMPLE TRADE

PERFORMANCE IN DIFFERENT MARKETS

RISK/RETURN PROFILE

KEY DUE DILIGENCE CONSIDERATIONS

For the latest macro performance and strategy chart packs, click here.

*The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Data from the Hedge Fund Data Engine is provided on the following basis: (1) Hedge Fund Data Engine data is provided for informational purposes only; (2) information and data included in the Hedge Fund Data Engine are obtained from various third party sources including Aurum’s own research, regulatory filings, public registers and other data providers and are provided on an “as is” basis; (3) Aurum does not perform any audit or verify the information provided by third parties; (4) Aurum is not responsible for and does not warrant the correctness, accuracy, or reliability of the data in the Hedge Fund Data Engine; (5) any constituents and data points in the Hedge Fund Data Engine may be removed at any time; (6) the completeness of the data may vary in the Hedge Fund Data Engine; (7) Aurum does not warrant that the data in the Hedge Fund Data Engine will be free from any errors, omissions or inaccuracies; (8) the information in the Hedge Fund Data Engine does not constitute an offer or a recommendation to buy or sell any security or financial product or vehicle whatsoever or any type of tax or investment advice or recommendation; (9) past performance is no indication of future results; and (10) Aurum reserves the right to change its Hedge Fund Data Engine methodology at any time and may elect to supress or change underlying data should it be considered optimal for representation and/or accuracy.

Disclaimer

This Post represents the views of the author and their own economic research and analysis. These views do not necessarily reflect the views of Aurum Fund Management Ltd. This Post does not constitute an offer to sell or a solicitation of an offer to buy or an endorsement of any interest in an Aurum Fund or any other fund, or an endorsement for any particular trade, trading strategy or market. This Post is directed at persons having professional experience in matters relating to investments in unregulated collective investment schemes, and should only be used by such persons or investment professionals. Hedge Funds may employ trading methods which risk substantial or complete loss of any amounts invested. The value of your investment and the income you get may go down as well as up. Any performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable indicator of future results. Returns may also increase or decrease as a result of currency fluctuations. An investment such as those described in this Post should be regarded as speculative and should not be used as a complete investment programme. This Post is for informational purposes only and not to be relied upon as investment, legal, tax, or financial advice. Whilst the information contained in this Post (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Aurum to be reliable, it is not guaranteed as to its accuracy or completeness. This Post is current only at the date it was first published and may no longer be true or complete when viewed by the reader. This Post is provided without obligation on the part of Aurum and its associated companies and on the understanding that any persons who acting upon it or changes their investment position in reliance on it does so entirely at their own risk. In no event will Aurum or any of its associated companies be liable to any person for any direct, indirect, special or consequential damages arising out of any use or reliance on this Post, even if Aurum is expressly advised of the possibility or likelihood of such damages.