Insight

What investors look for when selecting hedge funds

Introduction

In the past three parts of our hedge fund basics series, we’ve looked at how hedge funds can reduce performance volatility and provide portfolio diversification. But looking at hedge funds as a whole fails to recognise a crucial truth: hedge funds are not a homogenous group. There is huge performance dispersion in an industry of around 3,000 funds, both across hedge fund strategies and between individual hedge funds.

In the final part in our series, we will examine what investors look for when selecting hedge funds. Before investing in a hedge fund, investors need to consider the role they want their hedge fund allocation to play in their portfolio and use this to inform their fund and strategy selection. Hedge fund strategies and quality of management vary between hedge funds, and this impacts their ability to enhance returns and protect portfolios during equity market downturns.

Investors looking to hedge funds to provide diversification and protection in times of market weakness need to carefully consider strategy selection.

About Aurum

Aurum is an investment management firm focused on selecting hedge funds and managing fund of hedge fund portfolios for some of the world’s most sophisticated investors. Aurum also offers a range of single manager feeder funds.

Aurum’s portfolios are designed to grow and protect clients’ capital, while providing consistent uncorrelated returns. With 30 years of hedge fund investment experience, Aurum’s objective is to lower the barriers to entry enabling investors to access the world’s best hedge funds.

Aurum conducts extensive research and analysis on hedge funds and hedge fund industry trends. This research paper is designed to provide data and insights with the objective of helping investors to better understand hedge funds and their benefits.

There is huge performance dispersion in an industry of around 3,000 funds, both across hedge fund strategies and between individual hedge funds.

Strategy

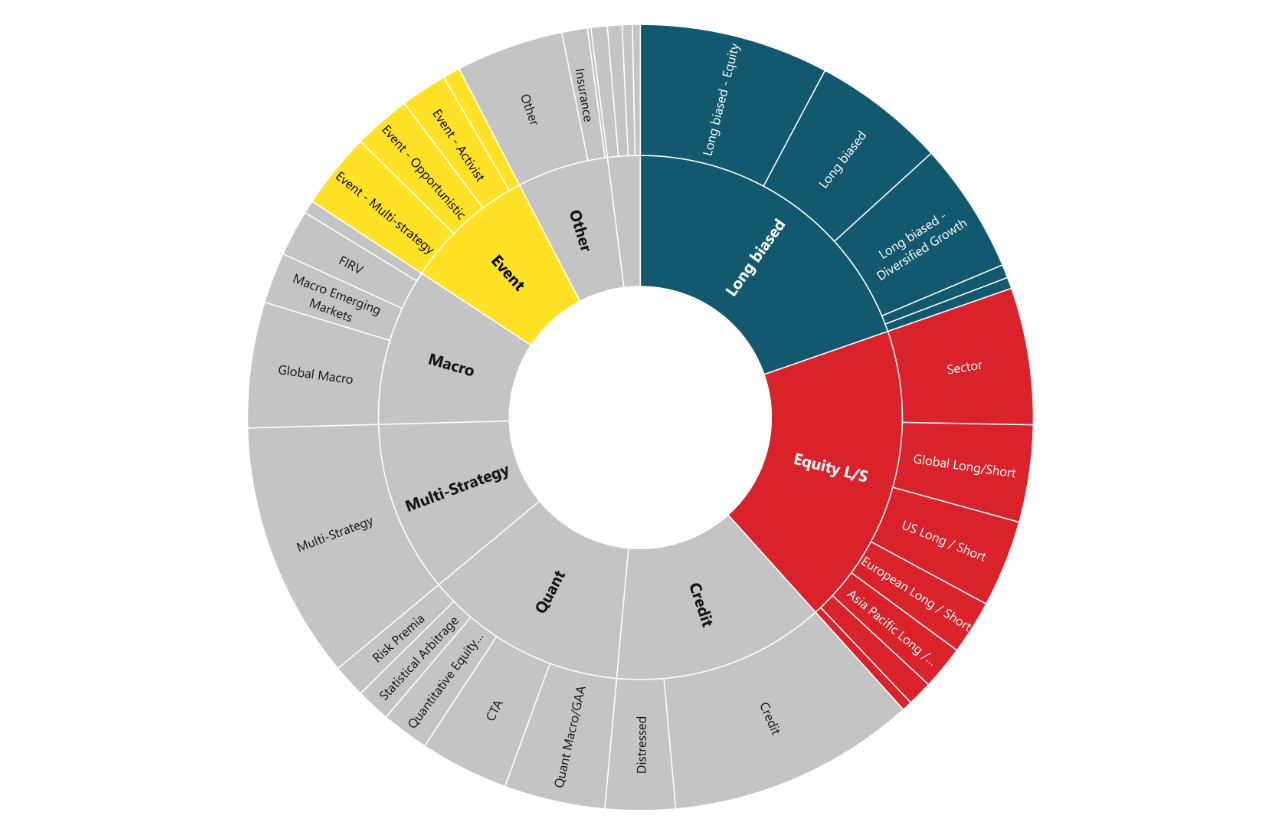

FIGURE 1: HEDGE FUND INDUSTRY BY STRATEGY

Aurum’s proprietary Hedge Fund Data Engine tracks the performance of around 3,000 hedge funds, representing around $3.1 trillion of assets across all hedge fund strategies.

FIGURE 2: EQUITY-BASED HEDGE FUND STRATEGIES

46% of the hedge fund industry (by assets) monitored by Aurum employs equity-based strategies which can be exposed to equity market volatility. The strategies highlighted here have a weighted average correlation to MSCI World Index USD of 0.87 and beta of 0.45 (performance period January 2013 – December 2021). Looking at the performance of the hedge fund industry during the extreme equity market volatility in 2022 on Aurum’s live hedge fund data page illustrates this – view it here,

Source: Aurum Hedge Fund Data Engine

FIGURE 3: CREDIT-BASED HEDGE FUND STRATEGIES

13% of the hedge fund industry (by assets) monitored by Aurum employs credit-based strategies, which are less liquid. Illiquid strategies can suffer disproportionately during periods of heighted volatility and uncertainty. The credit strategies highlighted here have a weighted average correlation to Barclays Global Aggregate Bond Index USD of 0.32 and beta of 0.30 (performance period January 2013 – December 2021). 2022 has seen a prolonged period of market volatility and poor performance for bonds. Aurum’s live hedge fund data page illustrates how credit strategies have fared in the difficult environment of 2022 – view it here,

Performance period: January 2013 – December. 2021 Weighted average correlation and beta to Barclays Global Aggregate bond Index USD. Source: Aurum Hedge Fund Data Engine

FIGURE 4: HEDGE FUND STRATEGIES THAT MAY OFFER UNCORRELATED RETURNS

31% of the remainder of the hedge fund industry (by assets) monitored by Aurum is represented by funds which may have the power to offer uncorrelated, alpha-rich return streams to investors.

Source: Aurum Hedge Fund Data Engine

Dispersion

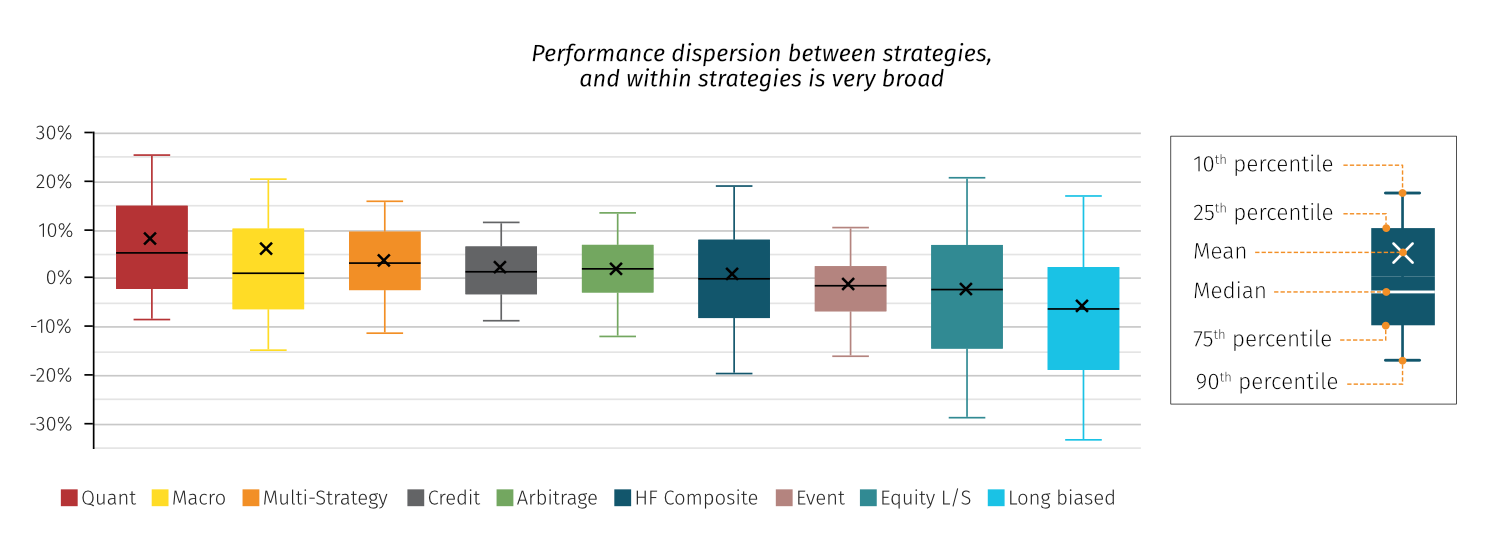

Looking beyond strategy, there is a large variation in returns across the industry.

Looking at the dispersion chart below, let’s take the quant strategy as an example. The median return was around 6%. But this average figure belies broad dispersion in the underlying funds in the strategy. The top decile of quant funds had a +25% return over the period, and the bottom decile of quant funds returned -9%, illustrating the importance of manager selection, as well as strategy.

Both hedge fund manager and hedge fund strategy selection are critical in order to generate the returns investors are seeking from their hedge fund investments. You can read more about this here.

FIGURE 5: RETURN BY MASTER STRATEGY – (JUN 2021 – MAY 2022)

Source: Aurum Hedge Fund Data Engine

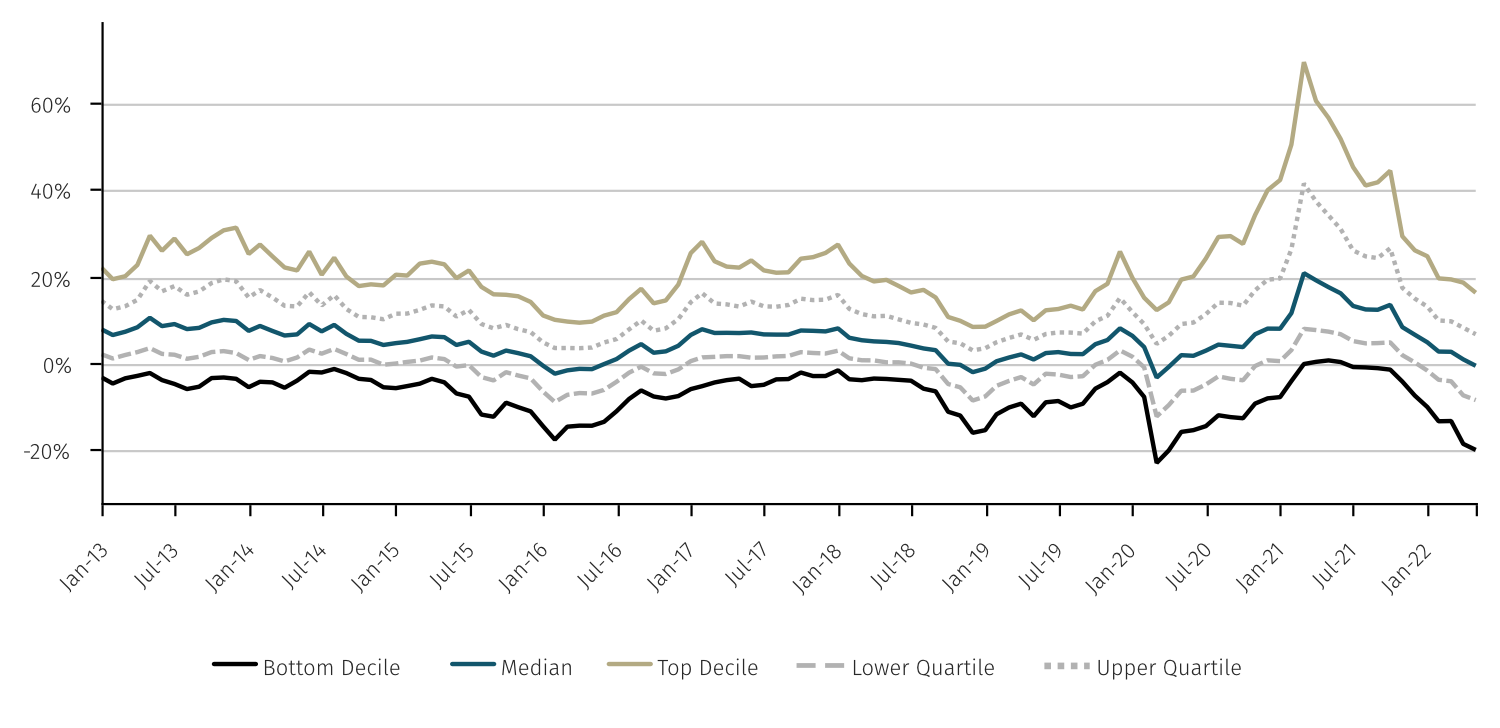

FIGURE 6: HEDGE FUND DISPERSION – 12M ROLLING RETURN

Investors are increasingly looking at hedge funds in response to rising volatility and uncertainty in traditional assets. Understanding which hedge fund strategies complement their portfolio and thoroughly researching the managers within those strategies requires careful consideration. But this is vital in order to select hedge funds that can not only generate the returns investors are seeking, but offer the best diversification or protection for their portfolios in times of market weakness.

Hedge fund basics series

See the full series here

*The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Data from the Hedge Fund Data Engine is provided on the following basis: (1) Hedge Fund Data Engine data is provided for informational purposes only; (2) information and data included in the Hedge Fund Data Engine are obtained from various third party sources including Aurum’s own research, regulatory filings, public registers and other data providers and are provided on an “as is” basis; (3) Aurum does not perform any audit or verify the information provided by third parties; (4) Aurum is not responsible for and does not warrant the correctness, accuracy, or reliability of the data in the Hedge Fund Data Engine; (5) any constituents and data points in the Hedge Fund Data Engine may be removed at any time; (6) the completeness of the data may vary in the Hedge Fund Data Engine; (7) Aurum does not warrant that the data in the Hedge Fund Data Engine will be free from any errors, omissions or inaccuracies; (8) the information in the Hedge Fund Data Engine does not constitute an offer or a recommendation to buy or sell any security or financial product or vehicle whatsoever or any type of tax or investment advice or recommendation; (9) past performance is no indication of future results; and (10) Aurum reserves the right to change its Hedge Fund Data Engine methodology at any time and may elect to supress or change underlying data should it be considered optimal for representation and/or accuracy.

Disclaimer

This Post represents the views of the author and their own economic research and analysis. These views do not necessarily reflect the views of Aurum Fund Management Ltd. This Post does not constitute an offer to sell or a solicitation of an offer to buy or an endorsement of any interest in an Aurum Fund or any other fund, or an endorsement for any particular trade, trading strategy or market. This Post is directed at persons having professional experience in matters relating to investments in unregulated collective investment schemes, and should only be used by such persons or investment professionals. Hedge Funds may employ trading methods which risk substantial or complete loss of any amounts invested. The value of your investment and the income you get may go down as well as up. Any performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable indicator of future results. Returns may also increase or decrease as a result of currency fluctuations. An investment such as those described in this Post should be regarded as speculative and should not be used as a complete investment programme. This Post is for informational purposes only and not to be relied upon as investment, legal, tax, or financial advice. Whilst the information contained in this Post (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Aurum to be reliable, it is not guaranteed as to its accuracy or completeness. This Post is current only at the date it was first published and may no longer be true or complete when viewed by the reader. This Post is provided without obligation on the part of Aurum and its associated companies and on the understanding that any persons who acting upon it or changes their investment position in reliance on it does so entirely at their own risk. In no event will Aurum or any of its associated companies be liable to any person for any direct, indirect, special or consequential damages arising out of any use or reliance on this Post, even if Aurum is expressly advised of the possibility or likelihood of such damages.