Hedge Fund Data

Hedge fund industry deep dive – H1 22

In summary…

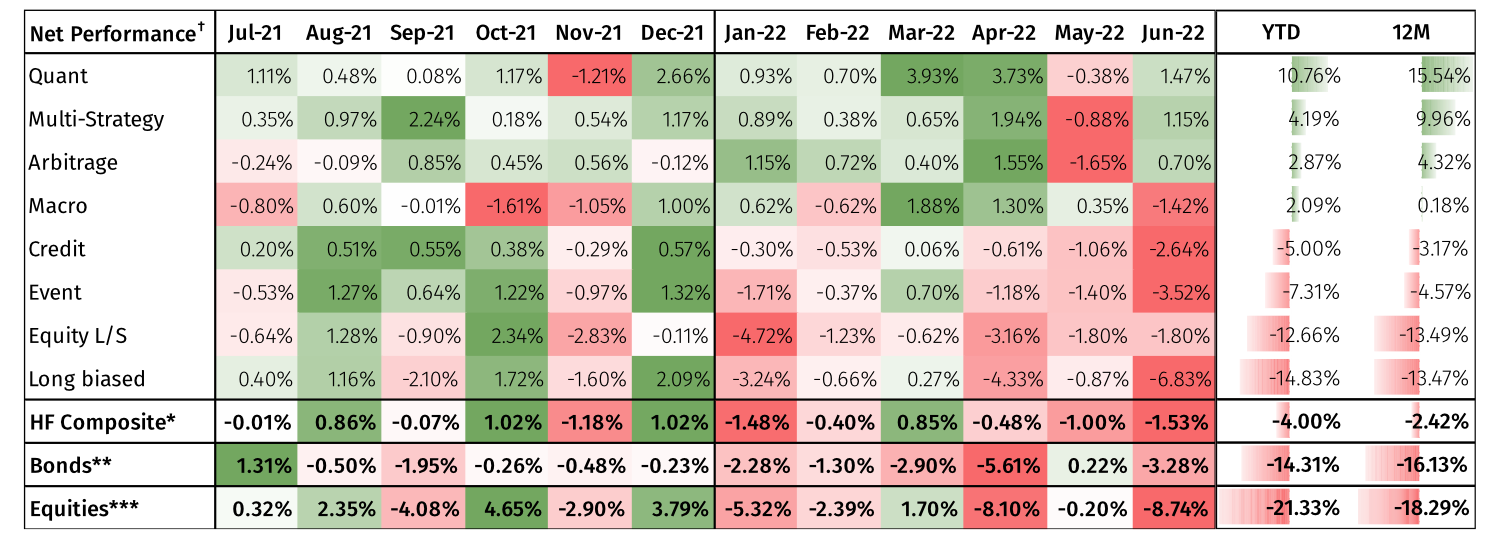

- Hedge fund performance was down 4.0% YTD.

- H1 2022 has been an extraordinarily challenging time period, not only for financial markets, but also for the global geopolitical landscape.

- Industry-wide hedge fund assets shrunk in H1 2022, primarily driven by negative performance.

- Quant is the best performing master strategy year to date, up 10.8%.

- Strategies that typically exhibit a higher beta to equities areas have struggled; the worst performing master strategy year to date is long-biased (-14.8%),

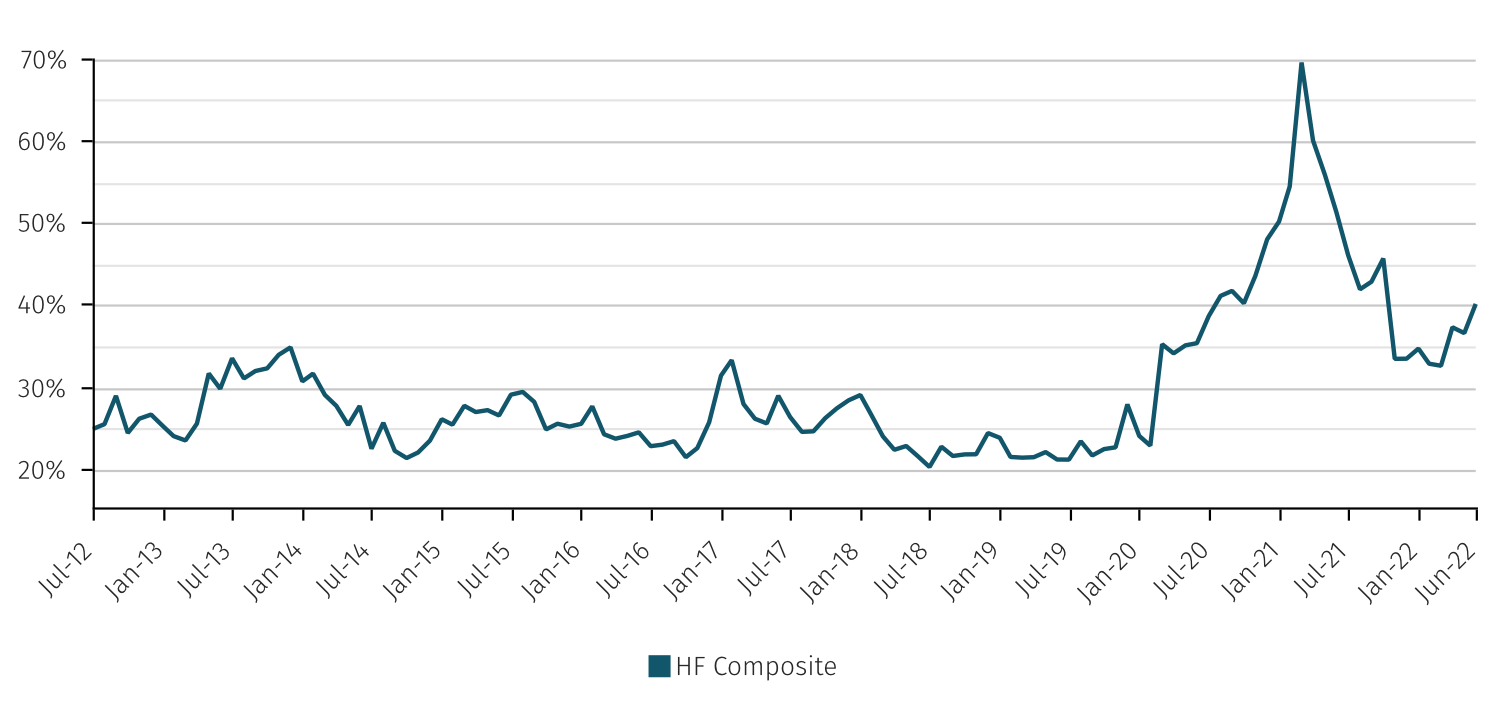

- Despite dispersion being lower than during the height of 2020-21, hedge fund industry dispersion remains high relative to the last ten years.

- Strategy correlation has also exhibited some significant changes over the last 12 months, as some areas have shown considerably more resilience to recent market pressures compared to others.

H1 2022 overview

Coming into 2022, there was hope of a return to ‘normality’ following the low points caused by the COVID-19 pandemic. However, in January there was a reminder by the WHO that the pandemic was certainly not over, warning that the spread of Omicron would likely result in further mutations. At the back end of 2021, inflation was already at 40-year highs and the Fed changed their narrative, dropping the word ‘transitory’ in their communications. Central bank quantitative easing, for the most part, has come to an end, moving to a world of quantitative tightening and interest rate rises in an attempt to combat the highest inflation witnessed in decades. Decades of loose monetary policies throughout the world have now started to reverse.

The first half of the year has been an extraordinarily challenging time period, not only for financial markets, but also for the global geopolitical landscape

The first half of the year has been an extraordinarily challenging time period, not only for financial markets, but also for the global geopolitical landscape. On the 24th February Russian forces invaded Ukraine, resulting in a devastating and ongoing human cost, condemnation by the West, and the imposition of heavy sanctions. The invasion of Ukraine has also led to significant volatility in global financial markets and exacerbated global geopolitical tensions. Relations between the US and China continue to deteriorate. Nicholas Burns, the US’s Ambassador to China described relations as in the worst state since Nixon’s historic visit to re-establish diplomatic ties with China in 1972. As part of the fallout from the Russian invasion, the West has looked to reduce its reliance on the supply of Russian energy. In a recent investor call, Robert Kapito (President of Blackrock) indicated that these actions are “effectively removing 7.5% from global supply” at what is already a precarious time. Constraints on energy supply, due to a lack of historical investment, has combined with the post-pandemic global demand surge to devastating effect. Commodity prices have surged, particularly across the energy complex. This has been the principal driver of global inflation, with the war in Ukraine exacerbating supply pressures.

Global policymakers are facing significant challenges. On the one hand, inflation has been more persistent than originally anticipated. Cost pressures have impacted corporate profits through wage inflation, financing, and energy inflation. However, attempts by central banks to dampen demand, bringing to an end decades of accommodative policy, have significantly increased fears that a ‘soft-landing’ is doubtful, with a recession a more likely result. Whilst contending with decisions on quantitative tightening and the pace of interest rate rises, there remain additional material factors outside central banks’ control. As well as the ongoing war in Ukraine and associated severe sanctions on Russia, China’s growth remains challenged by COVID-19-related lockdowns, food prices are further pressured by droughts, and the ECB is beginning its own tightening cycle. There is not as much room for manoeuvre as we have seen in previous cycles. Europe’s situation is exacerbated by member states attempting to reduce their reliance on Russian imports.

While challenges remain, there are some brighter spots and reasons to be more positive. US consumer demand appears to remain relatively strong, as they hold a lot of cash. There is strong payroll growth in the US, counteracting arguments of a near-term recession. In China, it appears that the lockdowns are also not causing as much of a knock-on effect on the supply chain as originally feared. Finally, while financial conditions are undoubtedly tightening, they remain broadly accommodative (from a historical perspective).

Markets summary

It has been a torrid time for risk assets in the first half of the year. Global equities*** and Global bonds** have fallen 21.3% and 14.3%, while over the 12-month period, they have returned -18.3% and -16.1% respectively. The moves in fixed income in particular have been historic in magnitude with major bond indices reporting a fall of over 17.5% stretching back from January 2021 to mid-May 2022, the biggest drop since data began in 1990. The positive correlation between equities and bonds has had ramifications for the classic 60/40[1] portfolio, as it suffered its worst first-half decline since 1988 with a Bloomberg article stating the Bloomberg US 60/40 index down 17%[2]. By stark contrast, the commodity space has stood out as an attractive hedge against rising inflation. Constraints on supply, combined with the post-pandemic boost in demand, has led to multiple commodities seeing their prices surge in the first half of the year, in particular energy exceeding 50% as well as softs such as corn and wheat, up over 10%.

In fixed income, yield curves flattened and bond yields rose in the first half of the year, amid exacerbating inflation concerns. It is worth taking a moment to reflect on the sheer scale of the bond losses. Bloomberg sums it up well in an article on 1 July “a year-to-date loss that eclipses even the biggest annual losses since the early 1970s. A broad index measuring the performance of Treasuries has fallen over 9% in 2022. Since 1973, the bond market has only posted five annual declines, with the most recent being a drop in the region of 2% last year.” Credit markets have sold-off significantly, the US Corporate bonds and US dollar high yield (“HY”) are both down around 14%, and emerging market bonds down just below 20%. In a recent call Jose Aguilar (Head of European HY at Blackrock) put valuations into perspective, saying that the 8% yield available in high yield compares favourably to the peak of the COVID-19 crisis in 2020, when spreads got out as far as 9% for a couple of weeks. “These levels of yield are more than pricing in a recession.”

Elsewhere in markets it should come as no surprise that the US dollar, as a safe haven currency, is up significantly, close to double digit gains on the year.

Hedge fund industry performance review

Asset growth

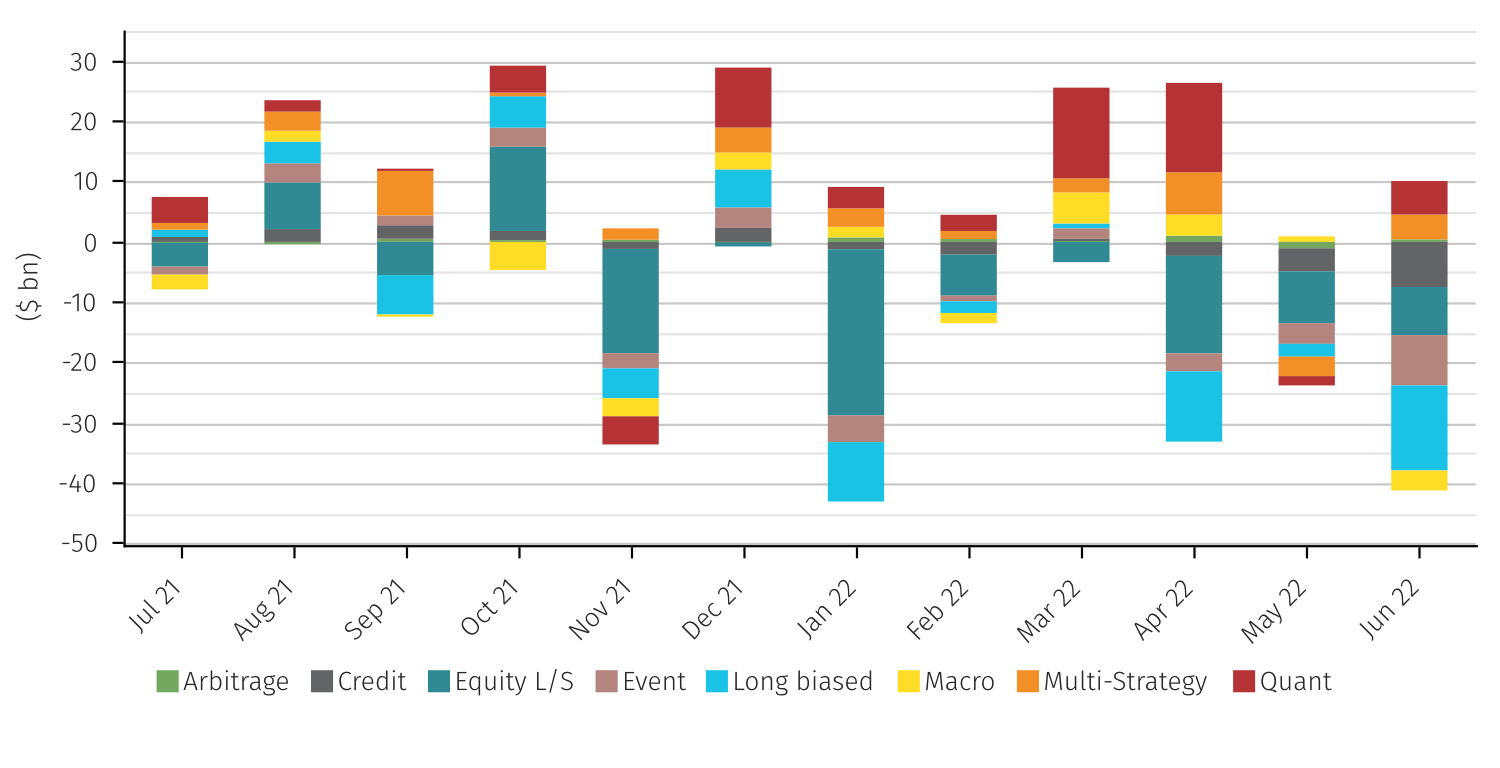

Hedge fund assets covered by the Aurum Hedge Fund Data Engine ($3.0 trillion as at 30th June) shrunk in the first half of 2022 primarily driven by negative performance (net P&L of-$-101.7bn) as well as net outflows of $41.9bn. Equity l/s funds saw the most significant reduction in dollar terms, while from a flows perspective there were significant net outflows from long-biased, credit, macro and quant strategies. Multi-strategy was – once again – the biggest beneficiary, not only growing from positive performance, but also from significant inflows (see page 23 of report) combining to well over +$30bn. None of the other master strategies saw net investor inflows during the period.

Headline performance

The hedge fund industry has struggled in H1 2022, down 4.0% YTD after having finished up 7.32% in 2021. The rolling 12-month performance for the hedge fund industry in aggregate sits at -2.42%, with the losses in 2022 more than offsetting the modest returns of the second half of 2021. These losses have been primarily driven by the historically challenging market conditions for equities and bonds described above.

As seen in the following chart, dispersion between the top and bottom decile performing hedge funds has risen in H1 2022. As markets have become more volatile (although still nowhere near the extremes caused by COVID-19 and the resulting fallout in 2020-21), dispersion between top and bottom decile hedge funds is just shy of 40% and is very high relative to the last ten years.

NET RETURN OF MASTER STRATEGIES

*HF Composite = Aurum Hedge Fund Data Engine Asset Weighted Composite Index. **Bonds = S&P Global Developed Aggregate Ex Collateralized Bond (USD). ***Equities = S&P Global BMI. † = Returns net of all fees and expenses.

There were some distinct ‘winners’ and ‘losers’ from a strategy perspective; the best performing were quant (+10.8%), multi-strategy (+4.2%), arbitrage (+2.9%) and macro (2.1%). Unsurprisingly – given the poor performance of risk-assets across equities and fixed income, strategies that typically exhibit a higher beta to those areas have struggled; long-biased performed the worst (-14.8%), followed by equity l/s (-12.7%), event (-7.3%) and credit (-5.0%).

Quant’s recent resurgence has considerably narrowed the gap between the master strategies. Indeed, over this timeframe, there is now less than a 1.2% CAR differential between the bottom performing master strategy, credit (CAR: 3.3%) and equity l/s (CAR: 4.4%) with quant, macro, and long-biased strategies sandwiched in between. Arbitrage strategies have compounded at just under 4.8% and – along with multi-strategy funds – are the only hedge fund strategies in aggregate to have delivered a Sharpe ratio above 1 in the last five years. As covered below, the standout performer has been multi-strategy, up every year in the last five, including 2022 YTD delivering a CAR of 9.3% and a Sharpe ratio of 1.9.

10th – 90th PERCENTILE 12M ROLLING PERFORMANCE SPREAD*

*HF Composite = Aurum Hedge Fund Data Engine Asset Weighted Composite Index.

Bonds and equities have sold off every month in H1 2022, with the exception of March and May. The poorest performing hedge fund master strategies have demonstrated a pattern of correlated returns to bonds and equities. Long-biased, credit and event were down every month apart from March, mirroring the pattern in equity markets, while equity l/s did not manage a single up month in the first half of the year. On the flip side, quant strategies were strong across the board, with all the underlying sub-strategies positive in H1. The resurgence of CTAs in particular have been the main quant story (covered further below). They have been able to capitalise upon the establishment of sustained trends across multiple asset classes and persistently higher realised volatility levels.

The poorest performing hedge fund master strategies have demonstrated a pattern of correlated returns to bonds and equities

Multi-strategy funds have continued their consistent run of strong performance, up every year going back to 2008. More recently, the strategy has been up every single month in the last 12 months, with the exception of May 2022. Multi-strategy funds have consistently exhibited a lower beta to traditional risk assets; this year they have been able to capitalise on opportunities in relative value areas such as statistical arbitrage, low-net or market-neutral equity and fixed-income trading. In addition to this, a number of multi-strategy funds have allocations to more directional macro strategies, commodities has been a very strong area for these allocations. As highlighted above, commodities is an area in which inflation has manifested itself to the greatest degree. Aurum are aware of multiple large multi-strategy funds that have generated significant positive performance, particularly from the moves in oil and natural gas.

As indicated above, it has been a torrid time for equity l/s, not surprising given the significant net long bias of funds following the strategy[3]. In January the strategy lost 4.7% as equity markets sold off and there was a significant rotation from growth to value. This rotation was, in part, due to the Fed announcing a faster pace of tapering. Yields rose significantly and companies that needed to secure funding sold off aggressively. This included unprofitable tech, the consumer sector, healthcare and expensive growth names, which heavily trafficked by the equity l/s space. On the flip side, cheap/undervalued stocks, particularly in areas like energy and financials outperformed.

The event strategy was also an underperformer. It was the best performing master strategy in 2021, driven primarily by the activist sub-strategy, which has tended to run quite a high beta to equities. With the reversal in risk assets, it has been interesting to see the same sub-strategy dragging event down (event – activist is the worst performing across all the hedge fund sub-strategies, discussed further below). It has also been challenging for opportunistic and merger arbitrage funds, with a number of large deals delayed or falling through.

Arbitrage has been up every month so far in 2022, apart from May, posting its strongest returns in the most challenged months for bonds and equities (April and June). This is not surprising when one digs under the surface and sees that tail protection and volatility arbitrage strategies have performed exceptionally during this period of elevated volatility and asset class dispersion.

Dollar extraction

This part of the report describes, in dollar terms, how much – as a result of performance – has been generated or lost by particular strategies and the hedge fund industry as a whole. There was significant negative performance (or ‘dollar destruction’) towards the end of last year (Nov 21) and then in January and April in particular, there were very large losses (together totalling well over $70bn) with the majority coming from the equity l/s and long-biased funds. However, April’s figure was significantly offset by gains on the quant, macro and multi-strategy side. May and June’s losses were not as severe on a strategy-by-strategy perspective, however there was very little to offset the negative performance with only marginal gains from the macro and multi-strategy spaces. The strategy dollar returns and AUM relative to industry chart below needs some context. Given that the industry in general had negative performance, then the ‘percentage of industry total’ returns represents the relative share of a negative figure. As such, equity l/s were responsible for over 80% of the dollar losses experienced by the industry, whilst only representing approximately 20% of industry assets, a massive disappointment. Similarly, long biased strategies were nearly 50% of the net industry losses and represented about 10% of the assets. Credit’s negative contribution was in line with its size, event was disappointing and of course the big outperformer was quant, with positive contributions also provided by multi-strategy and macro (with arbitrage barely registering given it is such a small space). Quant funds represented just over 15% of the AUM and drove over -50% of the returns (i.e. a positive dollar generation given the industry as a whole lost money).

NET DOLLAR PERFORMANCE BY MASTER STRATEGY (1 YR)

-

Investments are split 60% in stocks and 40% in bonds.

-

Source: Bloomberg.com “Why now may be the wrong time to write off 60/40” 5th July 2022

The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Bond and equity indices

The S&P Global BMI and S&P Global Developed Aggregate Ex Collateralized Bond (USD) Total Return Index (the “S&P Indices”) are products of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Aurum Research Limited. Copyright © 2021 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. By accepting delivery of this Paper, the reader: (a) agrees it will not extract any index values from the Paper nor will it store, reproduce or further distribute the index values to any third party for any purpose in any format or by any means except that reader may store the Paper for its personal, non-commercial use; (b) acknowledges and agrees that S&P own the S&P Indices, the associated index values and all intellectual property therein and (c) S&P disclaims any and all warranties and representations with respect to the S&P Indices.