Hedge Fund Data

Does structure matter? Hedge funds v Alternative UCITS

In summary…

- Since their inception in 2007[1], alternative UCITS, a.k.a. alt UCITS, liquid alternatives, or UCITS hedge funds have been popular with investors.

- The broadening of investment possibilities in UCITS funds brought hedge fund-like investment strategies to a wider investor base

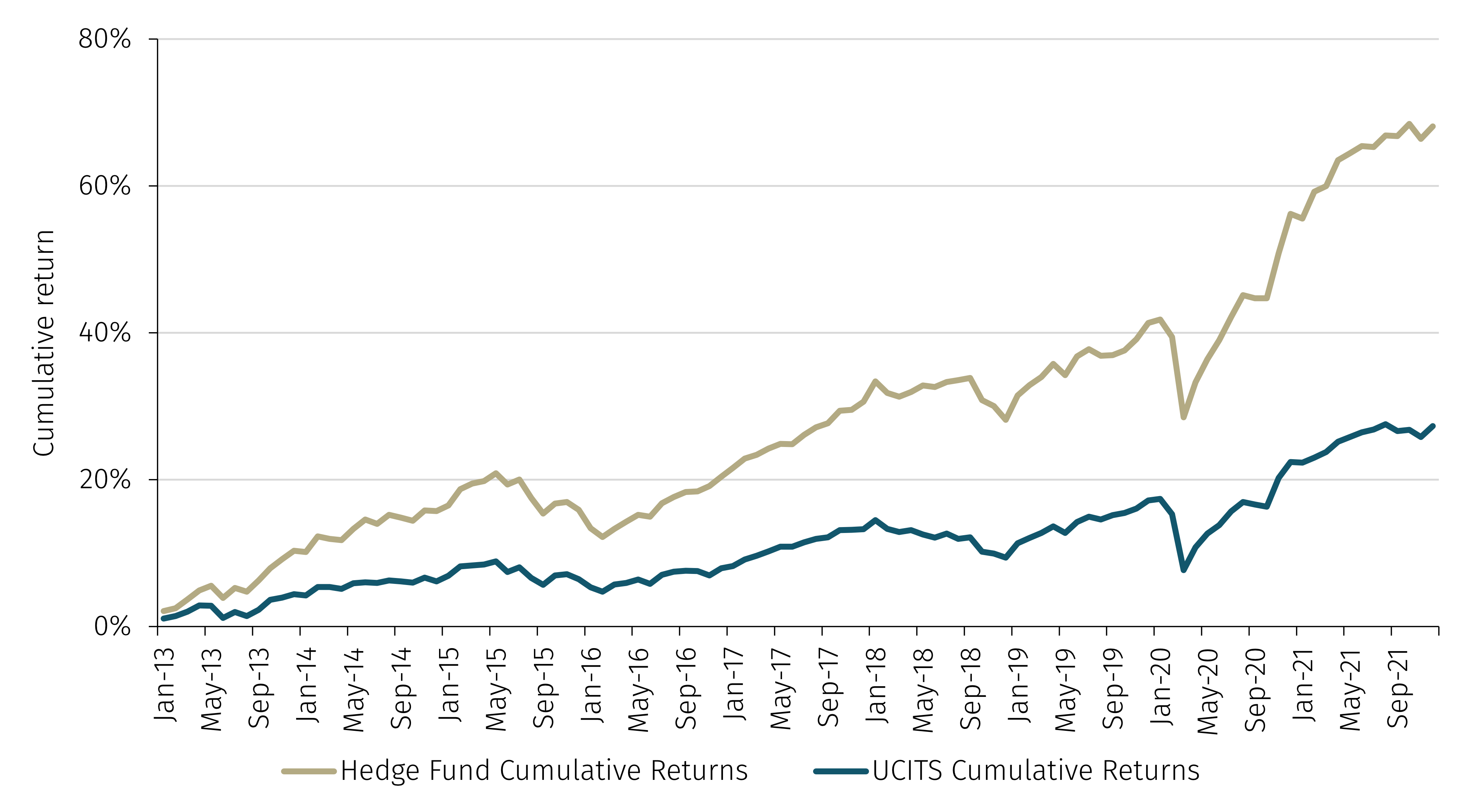

- Looking at alt UCITS v hedge fund returns from 2013 onwards a huge performance gap opens out between alt UCITS and hedge funds.

- Alt UCITS have an average total return over the period of 35.6%, and hedge funds have an average total return of 69.4%.

- Multi-strategy hedge funds vastly outperformed alt UCITS by 70.4% over the period.

Since their inception in 2007[1], alternative UCITS, a.k.a. alt UCITS, liquid alternatives, or UCITS hedge funds have been popular with investors.

Over the years EU legislation has widened the investment possibilities UCITS funds can undertake, expanding the investable universe to include covered short positions and the use of derivatives for investment purposes.

The broadening of investment possibilities in UCITS funds brought hedge fund-like investment strategies, previously only accessible to institutional investors, to a wider investor base, in Europe and beyond.

Investment restrictions

In practice, restrictions on the types of investments and their levels of concentration that can be held in the UCITS structure limit the available strategies and opportunity set compared to offshore hedge funds.

An example of this is the 5/10/40 rule, which was introduced to ensure diversification. UCITS funds may not invest more than 5% of net assets in securities from a single issuer. This can increase to 10%, as long as no more than 40% of the UCITS fund invested in these concentrated positions of 5% or more. This creates a theoretical minimum number of securities in a UCITS fund of 16, and limits the position size of high conviction holdings.

Another example of UCITS rules that limit the opportunity set is in relation to liquidity. UCITS funds must deal at least twice a month, but in practice most offer daily or weekly dealing. To meet the dealing terms their investors are offered, the underlying investments in UCITS funds must also be liquid. Less liquid underlying investments could cause a mismatch, and so the eligible assets for investment in a UCITS fund are more constrained than in hedge funds with less frequent dealing.

Many investors view these rules, the regulatory structure, portfolio transparency, liquidity, safekeeping of assets, transparent fees and oversight as creating a “safer” product than traditional offshore hedge funds.

So has this perception of “safety” come at a cost for those investors seeking hedge fund-like returns?

Performance

Source: Aurum Hedge Fund Data Engine

Looking back at alt UCITS v hedge fund returns² from 2013 onwards we can see that a huge performance gap opens out between alt UCITS and hedge funds. Looking at asset weighted net performance, alt UCITS have an average total return over the period of 35.6%, and hedge funds have an average total return of 69.4%.

Source: Aurum Hedge Fund Data Engine

Hedge funds have outperformed alt UCITS by 34% over nine years!

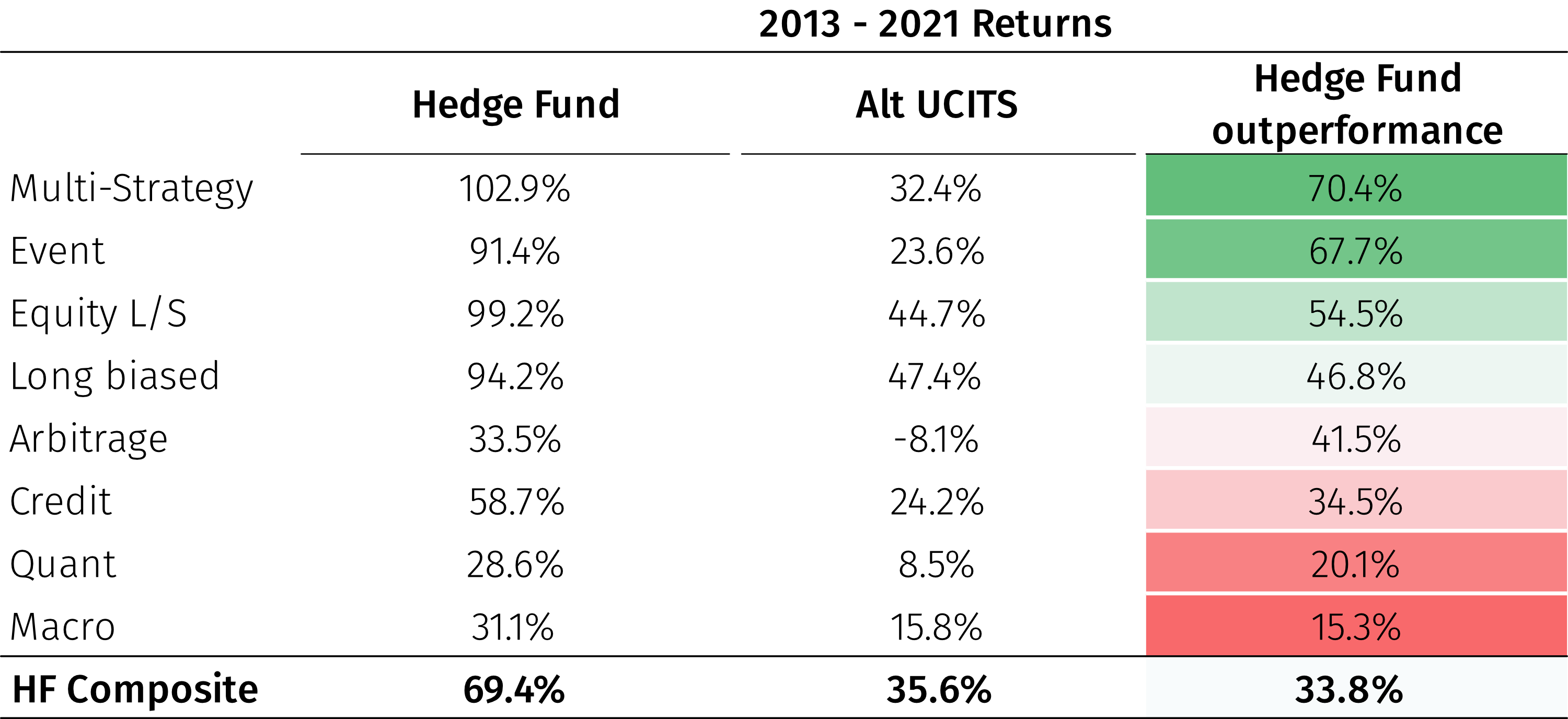

Are there any hedge fund-like strategies better suited to the alt UCITS structure?

Looking at returns on a strategy level, there are some strategies that have performed better than others within the alt UCITS structure. However, across all strategies, they don’t come close to their respective hedge fund counterpart performance over the period.

Source: Aurum Hedge Fund Data Engine

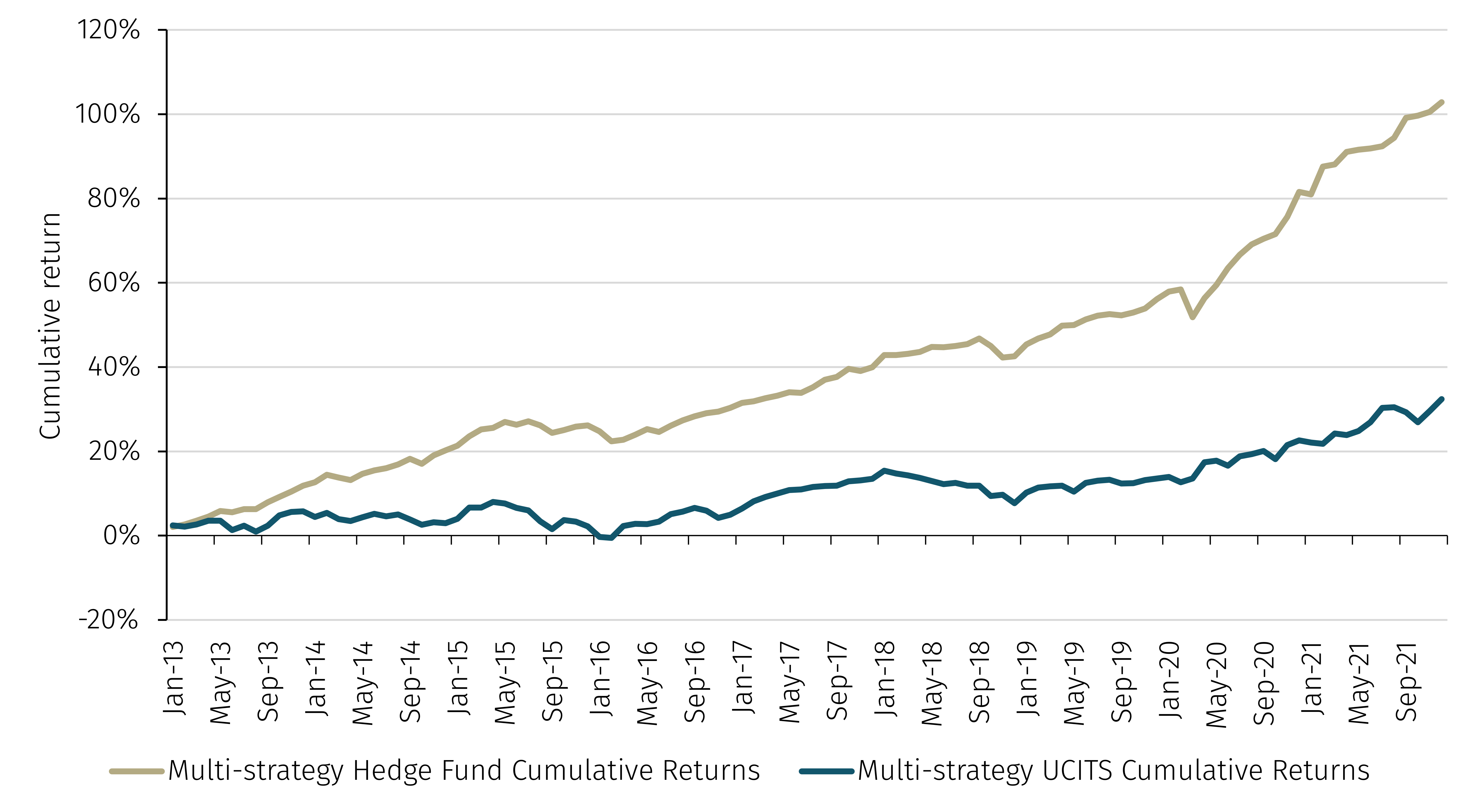

The largest difference in performance between hedge funds and alt UCITS funds within a strategy group is seen in multi-strategy, where hedge funds have vastly outperformed alt UCITS by 70.4% over the period.

Multi-strategy hedge funds vastly outperformed alt UCITS by 70.4% over the period.

There are many possible reasons for this large performance differential; one could be that liquidity constraints may shrink the possible investment universe for multi-strategy funds.

Another possibility could be down to varying fee models. UCITS funds tend to charge lower fees than hedge funds. The costs of large numbers of specialist research and trading teams at multi-strategy funds are high. Alt UCITS, with their lower fees, cannot support the expensive costs of multiple successful teams led by well-remunerated star PMs, and is perhaps another reason for the performance differential. The higher performance generated by the more expensive PMs at hedge funds appears to outweigh the higher fees.

A further possible reason for the performance differential between multi-strategy hedge funds and alt UCITS could be leverage limits. Many of the relative value strategies employed by multi-strategy hedge funds are typically highly levered. Statutory restrictions on leverage in alt UCITS funds limits their engagement in these strategies, and the potential return generated by them.

Source: Aurum Hedge Fund Data Engine

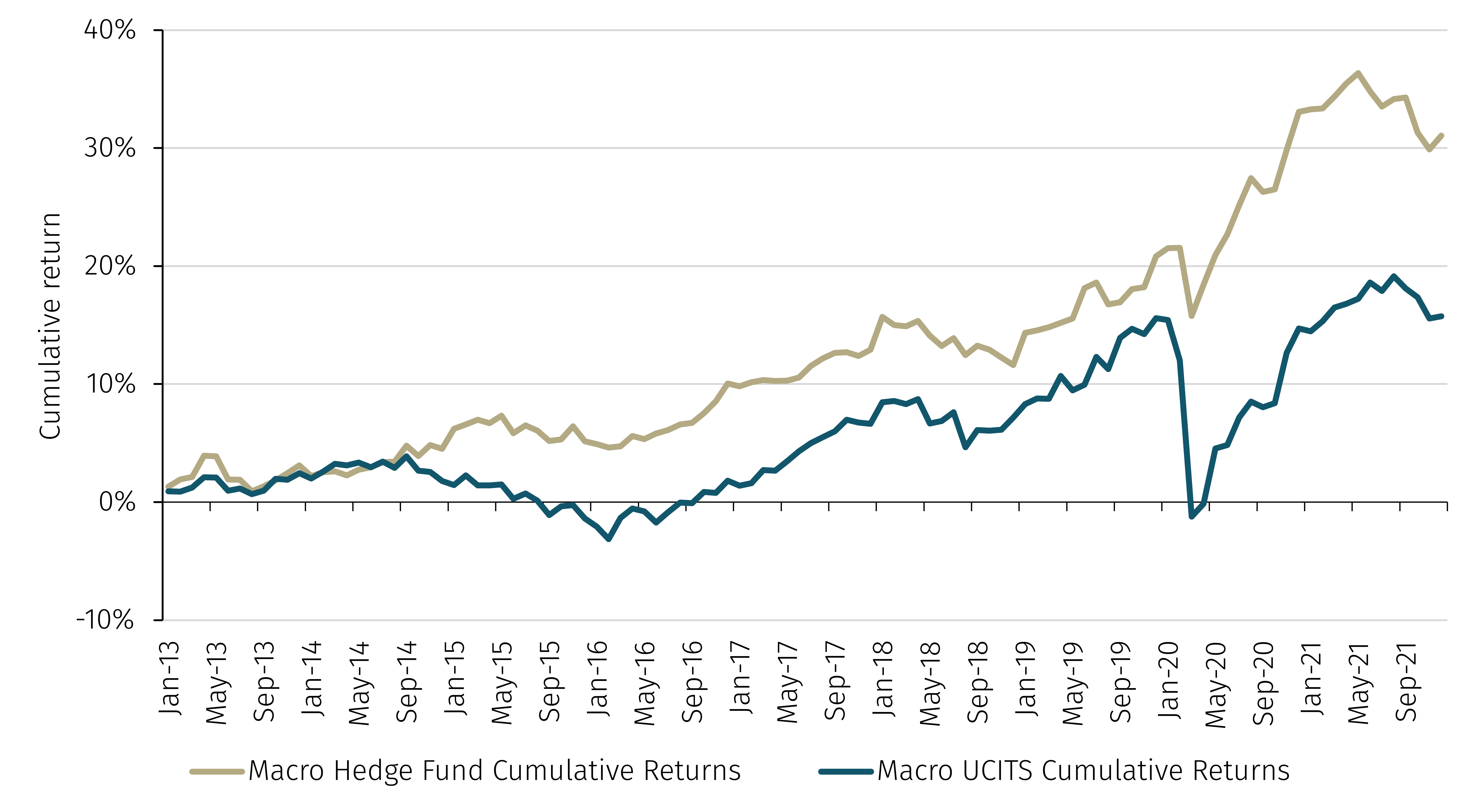

Macro is the strategy where the performance differential between hedge funds and alt UCITS is the smallest, with hedge funds having outperformed by 16.53% during the 2013 -2021 period.

However, it is significant to note the differential caused by the COVID-19-related market turbulence in early 2020! In aggregate, alt UCITS macro funds lost significantly more than their hedge fund counterparts in March 2020, failing to protect investors. At the end of 2021, alt UCITS Macro cumulative returns remained below their pre-March 2020 levels.

Source: Aurum Hedge Fund Data Engine

So, in conclusion it seems that the perception of safety and enhanced liquidity that alt UCITS offer seems to have come at a significant opportunity cost for investors. Particularly for those alt UCITS investors that don’t actually need the liquidity and regulatory structure of the UCITS wrapper.

Investors are increasingly looking at alternatives in light of increased volatility and uncertainty in traditional assets. They should carefully consider which alternatives can offer the best “protection” for their portfolios in times of market weakness.

-

Although alt UCITS funds first came into the market in 2007, UCITS funds go all the way back to 1985, when the first Directive on Undertakings for Collective Investment in Transferable Securities (UCITS) created a harmonised framework for investment funds to be sold to retail investors across the EU.

Disclaimer

This Post represents the views of the author and their own economic research and analysis. These views do not necessarily reflect the views of Aurum Fund Management Ltd. This Post does not constitute an offer to sell or a solicitation of an offer to buy or an endorsement of any interest in an Aurum Fund or any other fund, or an endorsement for any particular trade, trading strategy or market. This Post is directed at persons having professional experience in matters relating to investments in unregulated collective investment schemes, and should only be used by such persons or investment professionals. Hedge Funds may employ trading methods which risk substantial or complete loss of any amounts invested. The value of your investment and the income you get may go down as well as up. Any performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable indicator of future results. Returns may also increase or decrease as a result of currency fluctuations. An investment such as those described in this Post should be regarded as speculative and should not be used as a complete investment programme. This Post is for informational purposes only and not to be relied upon as investment, legal, tax, or financial advice. Whilst the information contained in this Post (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Aurum to be reliable, it is not guaranteed as to its accuracy or completeness. This Post is current only at the date it was first published and may no longer be true or complete when viewed by the reader. This Post is provided without obligation on the part of Aurum and its associated companies and on the understanding that any persons who acting upon it or changes their investment position in reliance on it does so entirely at their own risk. In no event will Aurum or any of its associated companies be liable to any person for any direct, indirect, special or consequential damages arising out of any use or reliance on this Post, even if Aurum is expressly advised of the possibility or likelihood of such damages.