Hedge Fund Data

Hedge fund industry performance deep dive – Full year 2023

In summary…

- A resurgence in risk assets provided a significant tailwind to more long-biased and/or historically higher beta strategies, which were among the worst performing strategies in 2022.

- There are a handful of sub-strategies that delivered strong performance both in 2022 and 2023 – quant – stat arb was up 10.9% in 2023 and 12.7% in 2022. While macro – FIRV was up 10.9% and 8.4%.

- Five-year performance (CAR) for hedge funds now stands at 6.5%, comfortably outperforming bonds (-0.4%) but underperforming equities (+9.4%) from a total return perspective, however, outperforming equities from a risk-adjusted perspective (Sharpe of 0.7 vs 0.5).

- Dispersion has continued to fall and now sits at levels more in line with those observed pre-COVID.

Contents:

Strategy chart packs

Hedge fund industry performance review

Asset growth

Seven of the eight hedge fund master strategies saw net growth in AUM, led by equity long/short, followed by multi-strategy.

Hedge fund assets – as measured by those funds reporting to Aurum’s Hedge Fund Data Engine – have grown by $93.2bn since the end of 2022 to stand at $2.9tn. This was driven by net positive performance (+$187.5bn) and partially offset by outflows (-$94.3bn). Seven of the eight hedge fund master strategies saw net growth in AUM, led by equity long/short, followed by multi-strategy. Equity long/short growth in AUM was exclusively driven by significant net positive P&L, which was offset by significant net investor outflows. Multi-strategy growth was predominantly driven by positive P&L, although was the only strategy to have had net positive investor inflows. The only other strategy to see total assets increase during the period by over $10bn is Macro, driven by positive P&L and partially offset by net investor outflows. Quant was the only category to see a fall in assets, with investor outflows only partially offset by net positive P&L.

Headline performance

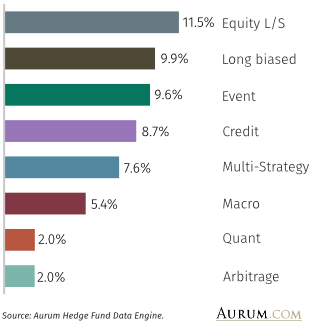

Equity long/short was also the strongest performing strategy returning 11.5% on an asset weighted basis and outperforming, with the headline figure dragged down by underperformance from quant (+2.0%), while multi-strategy funds were broadly in line with HF Composite figure.

NET RETURN (1 YR)

The hedge fund industry was up 7.9% for the year on an asset weighted basis. This compares to the mean figure of 8.5%, suggesting that, on average, larger hedge funds have underperformed. The median performing hedge fund returned 7.2% for the year. The median performing hedge fund sub-strategies were credit – direct lending (ranked 18thth out of 36 sub-strategies returning 8.0%) and arb-CB (19th: 8.0%). The largest constituent of the hedge fund universe was equity long/short (over 20% of assets), followed by multi-strategy and long biased both constituting ~14%. Equity long/short was also the strongest performing strategy returning 11.5% on an asset weighted basis and outperforming, with the headline figure dragged down by underperformance from quant (+2.0%), while multi-strategy funds were broadly in line with HF Composite figure.

Those strategies that performed strongly in 2022 in the higher volatility regime and risk-asset selloff were among the worst performing in 2023. Arb – Tail is down over 10%, Quant – CTA having returned over 15% in 2022, was down 3.8% in 2023.

A resurgence in risk assets provided a significant tailwind to more long-biased and/or historically higher beta strategies such as event – activist (+20.9%), long – equity (+14.4%), global equity (+14.3%), and long – other (14.2%). It should be noted that all of these strong performing areas were among the worst performing in 2022.

On the other end of the scale some of those strategies that performed strongly in 2022 in the higher volatility regime and risk-asset selloff are among the worst performing in 2023. Arb – Tail is down over 10%, quant – CTA having returned over 15% in 2022, was down 3.8% in 2023. Interestingly commodity strategies have also struggled during the year.

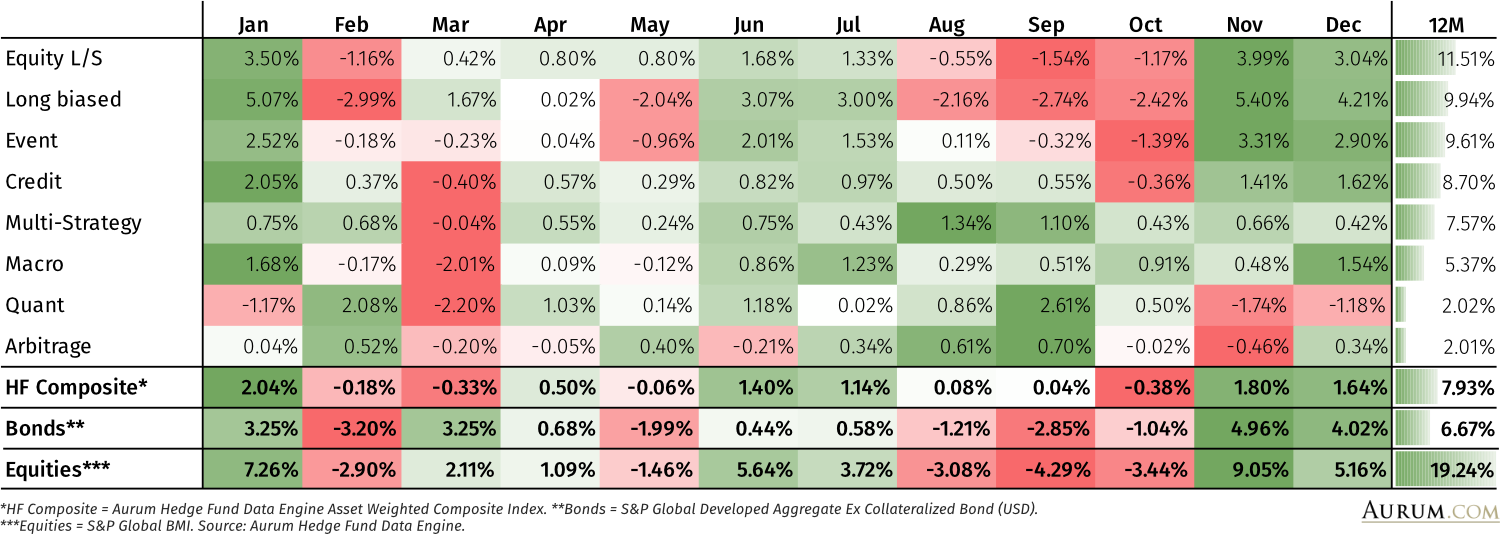

H1 performance was heavily skewed to the start of the year and at the end of Q2. Performance was then solid in June/July, flat to marginally negative for three months (during which time both bonds and equities sold off significantly), before rallying into year end alongside the rally in risk assets – standout months during the year were March (-0.3%), predominantly driven by a tough month for macro strategies (both macro – global macro and quant – CTA sub-strategies in particular) and – to a lesser extent – credit. October was also a down month (-0.4%) driven by negative performance across equity long/short, long biased, and event. This is covered in more detail below.

There are a handful of sub-strategies that delivered strong performance both in 2022 and 2023, so it is worth highlighting quant – stat arb, macro – FIRV, quant in particular. Quant – stat arb was up 10.9% in 2023 and 12.7% in 2022. Macro – FIRV was up 10.9% and 8.4% in 2022 and 2023 respectively.

Five-year performance (CAR) for hedge funds now stands at 6.5%, comfortably outperforming bonds (-0.4%) but underperforming equities (+9.4%) from a total return perspective, however, outperforming equities from a risk-adjusted perspective (Sharpe of 0.7 vs 0.5).

Five-year performance (CAR) for hedge funds now stands at 6.5%, comfortably outperforming bonds (-0.4%) but underperforming equities (+9.4%) from a total return perspective, however, outperforming equities from a risk-adjusted perspective (Sharpe of 0.7 vs 0.5).

Dispersion

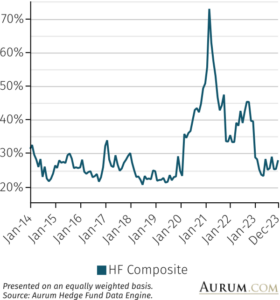

As can be seen in the following chart, dispersion between top and bottom decile performing hedge funds has fallen dramatically since the end of 2022, as has general risk-asset volatility. Dispersion sits at levels more in line with those observed pre-COVID.

10th – 90th PERCENTILE 12M ROLLING PERF. SPREAD[1]

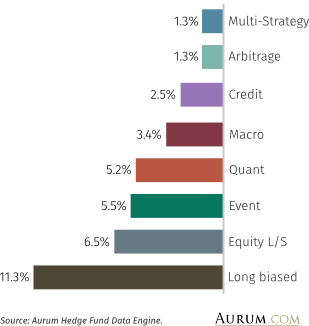

STANDARD DEVIATION (1 YR)

Strategy performance

Multi-strategy funds, which have been the long-term consistent performers (5y CAR of 10.6% with a Sharpe of 2.2), performed more in line with the median hedge fund in 2023

As indicated above, top performing strategies have been those that have sub-strategy components that typically exhibit a higher beta to risk assets. Equity long/short is the top performing headline strategy (+11.5%) with a number of sub-strategies among the top performers. Event (+9.6%) has been driven by the top performing sub-strategy event – activist (+20.9%) ranking 1st out of all 36 sub-strategies. Credit funds have also outperformed the broader hedge fund universe (+8.7%), driven by credit – multi (+10.0%), credit – strucLO (+9.2%) and credit – distress (+9.1%).

Multi-strategy funds, which have been the long-term consistent performers (5y CAR of 10.6% with a Sharpe of 2.2), performed more in line with the median hedge fund in 2023 (7.6% vs the median of 7.2%).

The worst performing strategy was arbitrage (+2.0%), driven by material underperformance from the arb – tail sub-strategy (-10.0%) and mediocre performance from arb – vol (1.3%). It is no surprise that tail hedging strategies would underperform in 2023 given the falling realised and implied volatility and negative beta associated with the strategy. Arb – vol strategies had performed well in the more elevated volatility regime in 2022, with 2023 a much more muted environment.

Quant (+2.0%) struggled due to underperformance from CTAs (quant – CTA: -3.8%) and quant macro (quant – macro: -1.4%). CTAs struggled in March (-6.1%) in particular with the massive move in interest rates. The negative attribution from CTAs and quant macro strategies was more than offset by stronger performance in statistical arbitrage, quant equity market neutral and risk premia strategies respectively (quant – stat arb: +10.9%, quant – RP: 10.6%, quant – EMN: 8.1%).

NET RETURN (1 YR)

-

Presented on an equally weighted basis. Source: Aurum Hedge Fund Data Engine.

*HF Composite = Aurum Hedge Fund Data Engine Asset Weighted Composite Index. **Bonds = S&P Global Developed Aggregate Ex Collateralized Bond (USD).

***Equities = S&P Global BMI.

The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Bond and equity indices

The S&P Global BMI and S&P Global Developed Aggregate Ex Collateralized Bond (USD) Total Return Index (the “S&P Indices”) are products of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Aurum Research Limited. Copyright © 2021 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. By accepting delivery of this Paper, the reader: (a) agrees it will not extract any index values from the Paper nor will it store, reproduce or further distribute the index values to any third party for any purpose in any format or by any means except that reader may store the Paper for its personal, non-commercial use; (b) acknowledges and agrees that S&P own the S&P Indices, the associated index values and all intellectual property therein and (c) S&P disclaims any and all warranties and representations with respect to the S&P Indices.