Insight

The key features of hedge funds – understand them better

What is a hedge fund? And what is it about hedge funds that makes them different from other investment products, like mutual funds? In the first part in our educational series about hedge funds, we go back to basics, looking at what hedge funds are and the key features of the asset class.

Geopolitical issues and rising inflation have created a challenging environment for equities. Investors are seeking investment options that diversify away from the risk in traditional asset classes and can also provide some downside protection during stressed markets. So, it isn’t surprising that investors are increasingly turning to hedge funds to meet these needs.

Over the last 30 years, Aurum has not seen any other liquid asset class deliver the type of uncorrelated, consistent return stream that hedge funds have provided.

As more investors seek downside protection, whilst maintaining upside potential, a case can be made that hedge funds have never had a more important role to play. However, hedge funds are complex investments following a wide variety of different investment strategies. There is also wide dispersion of returns across the industry.

With many investors looking at hedge funds for the first time, we thought it was a good time to provide some basic background and explore:

- what hedge funds are

- why investors include hedge funds in their portfolios

- some common myths about hedge funds and the reality

- why not all hedge funds will offer investors the protection investors seek

- some of the main hedge fund strategies and jargon used

In this four-part series, we will explore these topics. We will demonstrate the potential value well-selected hedge funds can bring to investors’ portfolios, but also the potential pitfalls of hedge fund investing.

What are hedge funds?

Hedge funds evolved to solve a problem for investors. Put simply, hedge funds were designed to generate real returns for investors, while protecting them from losses when markets fall.

At the most basic level, hedge funds are pooled investment vehicles which are largely unconstrained in the investments they can make. They can typically use a variety of investment instruments and strategies to generate real returns and mitigate risk. You can find an overview of the strategies that hedge funds employ here.

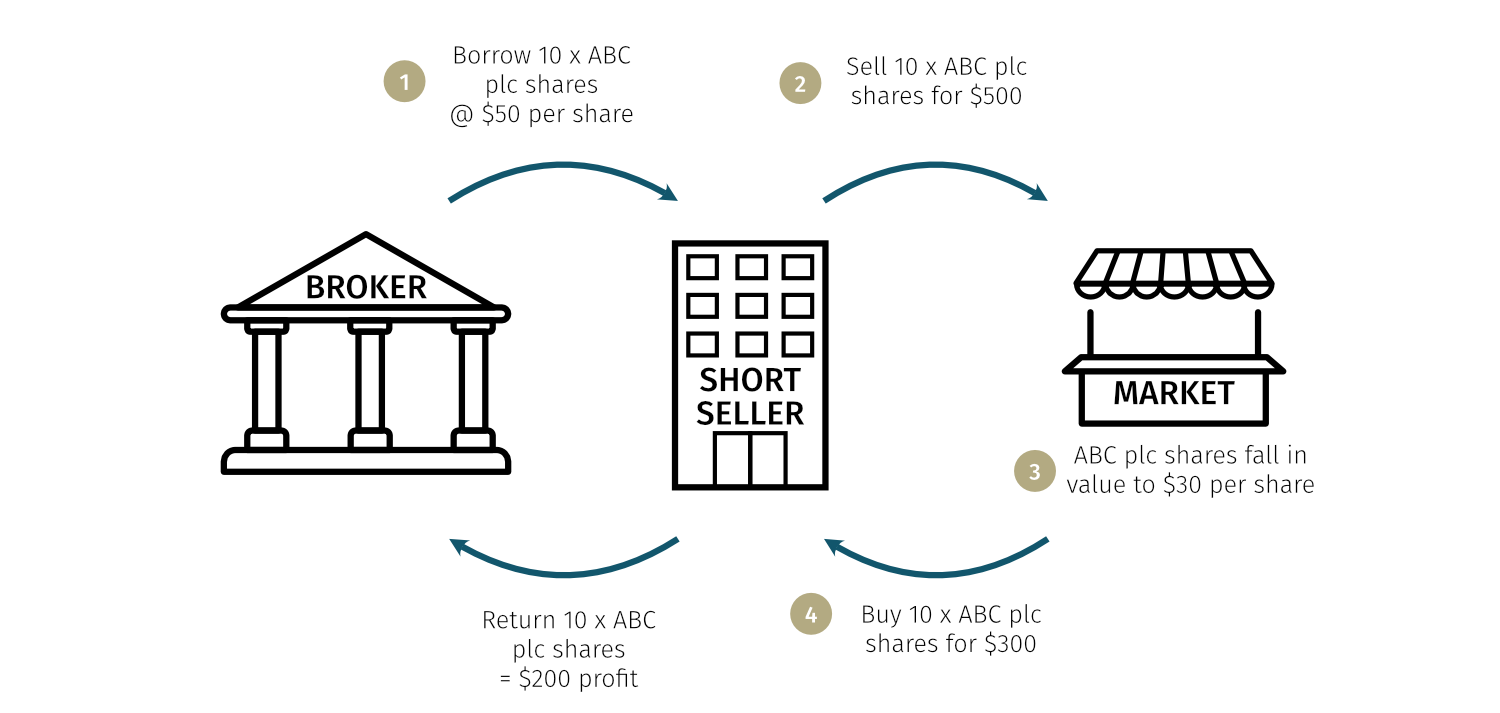

Hedge funds are not only able to go long in securities (e.g. equities/bonds) that they think will go up in price, but also to “short” securities that they expect will fall in price.

This is done by borrowing the securities (usually lent by a broker at a cost, which have to be returned at a later date) and selling the borrowed securities at the current market value. The securities are then repurchased at a later date, by which time the hedge fund hopes that the securities have fallen in price, and are returned to the lender. Being able to short is one way hedge funds are able to make profits in a falling market.

Key features of hedge funds:

Return enhancement

Hedge funds have the ability to use leverage, which means they can use borrowed money to increase the size of their positions in order to enhance returns. Although this also carries the risks of magnifying potential losses.

Risk management

The best hedge funds are specialists at minimising investment risks and make risk management an integral part of their investment plan. Conscientious risk management serves to limit losses and promotes more consistent, generally higher risk-adjusted returns.

Terms

Hedge funds differ from traditional “long only”, mutual funds in structure and investment terms:

- Absolute Return – whereas long only fund performance is generally tied to a benchmark, hedge funds target “absolute return”, regardless of the performance or direction of markets

- Performance Fee / Incentive Fee – hedge funds typically have a different fee structure – both hedge funds and long only funds generally charge a management fee, however hedge funds may also charge an “incentive” or “performance” fee, which is a percentage of the positive performance of the fund

- Minimum investments – hedge funds usually have high minimum investment amounts. They are not typically targeted at retail investors.

- Liquidity – the liquidity of long only funds and hedge funds also differs, whilst long only funds largely offer daily liquidity, hedge fund redemption dates tend to be monthly or quarterly (some are even longer), and have extended notice periods. Some hedge funds demand lock-up periods.

- Structure – whilst long only funds are managed and domiciled onshore (for example through European UCITS structures), hedge funds tend to be domiciled offshore, often in the Cayman Islands, Bermuda etc. That being said, the onshore presence of hedge funds is growing significantly, particularly in Ireland and Luxembourg.

In part two of the hedge fund basics series, we will look at why investors include hedge funds in their portfolios.

Hedge fund basics series

See the full series here

*The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Data from the Hedge Fund Data Engine is provided on the following basis: (1) Hedge Fund Data Engine data is provided for informational purposes only; (2) information and data included in the Hedge Fund Data Engine are obtained from various third party sources including Aurum’s own research, regulatory filings, public registers and other data providers and are provided on an “as is” basis; (3) Aurum does not perform any audit or verify the information provided by third parties; (4) Aurum is not responsible for and does not warrant the correctness, accuracy, or reliability of the data in the Hedge Fund Data Engine; (5) any constituents and data points in the Hedge Fund Data Engine may be removed at any time; (6) the completeness of the data may vary in the Hedge Fund Data Engine; (7) Aurum does not warrant that the data in the Hedge Fund Data Engine will be free from any errors, omissions or inaccuracies; (8) the information in the Hedge Fund Data Engine does not constitute an offer or a recommendation to buy or sell any security or financial product or vehicle whatsoever or any type of tax or investment advice or recommendation; (9) past performance is no indication of future results; and (10) Aurum reserves the right to change its Hedge Fund Data Engine methodology at any time and may elect to supress or change underlying data should it be considered optimal for representation and/or accuracy.

Disclaimer

This Post represents the views of the author and their own economic research and analysis. These views do not necessarily reflect the views of Aurum Fund Management Ltd. This Post does not constitute an offer to sell or a solicitation of an offer to buy or an endorsement of any interest in an Aurum Fund or any other fund, or an endorsement for any particular trade, trading strategy or market. This Post is directed at persons having professional experience in matters relating to investments in unregulated collective investment schemes, and should only be used by such persons or investment professionals. Hedge Funds may employ trading methods which risk substantial or complete loss of any amounts invested. The value of your investment and the income you get may go down as well as up. Any performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable indicator of future results. Returns may also increase or decrease as a result of currency fluctuations. An investment such as those described in this Post should be regarded as speculative and should not be used as a complete investment programme. This Post is for informational purposes only and not to be relied upon as investment, legal, tax, or financial advice. Whilst the information contained in this Post (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Aurum to be reliable, it is not guaranteed as to its accuracy or completeness. This Post is current only at the date it was first published and may no longer be true or complete when viewed by the reader. This Post is provided without obligation on the part of Aurum and its associated companies and on the understanding that any persons who acting upon it or changes their investment position in reliance on it does so entirely at their own risk. In no event will Aurum or any of its associated companies be liable to any person for any direct, indirect, special or consequential damages arising out of any use or reliance on this Post, even if Aurum is expressly advised of the possibility or likelihood of such damages.