Hedge Fund Data

Hedge fund industry deep dive – 2020

2020 Overview

2020 will go down in history, not only due to the tragic human cost of the COVID-19 pandemic, but also for the scars it has left on the global economy. After entering 2020 off the back of a positive economic expansion, we then saw the biggest contraction since the Great Depression. COVID-19 has also impacted human behaviour and the way we interact. As awful as the human and economic costs have been, the pandemic has also caused a number of transformations. In a recent Global Outlook1 talk given by Larry Fink of Blackrock, he stated that COVID-19 has led to changes in the way we live, the way we consume products, how we receive medical advice and of course how many people are now working every day. Fink makes the point that out of the tragedy, we should be encouraged by how across so many industries and walks of life we have been able to successfully adapt. Business functions have, in many cases, been able transfer to remote working. The research and development of a vaccine – something that a few years ago could have been a 10-15 year process – has taken 10 months, with a number of companies now distributing. This process has also seen the new ‘RNA’ method of vaccine production, something Fink described as “one of the most revolutionary” things in the pharmaceutical industry for the last 50 years.

Given how COVID-19 has been such a dominating feature of everyone’s lives, it would be easy to overlook a number of other significant themes and events. Key stories of the year include continuing US/China tensions, the US Elections, Brexit, the huge moves in oil and the interactions between these themes and the ongoing pandemic. Another key thematic of note, is how sustainable investing has now become more mainstream and represents one of the biggest structural shifts.

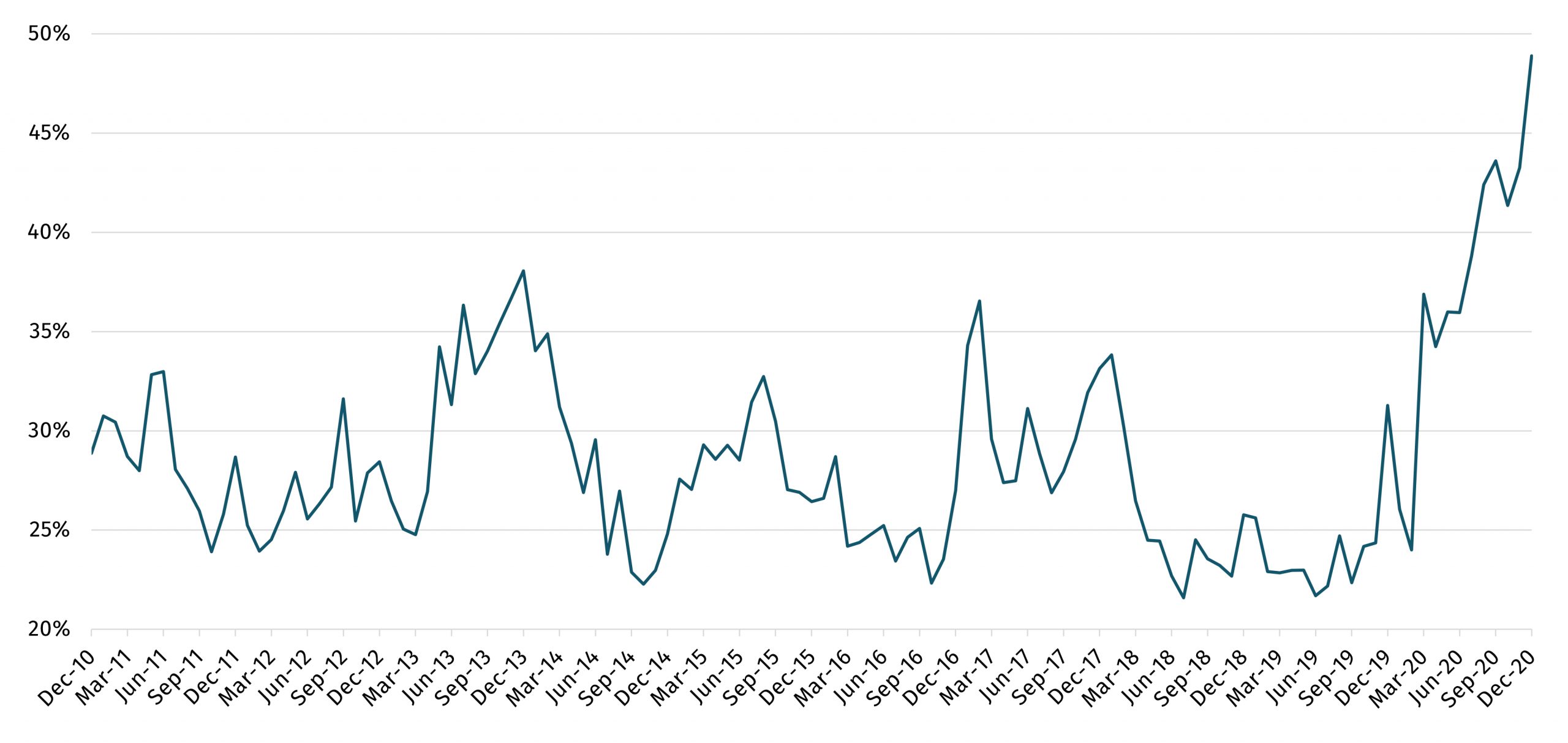

10th – 90th PERCENTILE 12M ROLLING PERFORMANCE SPREAD

Source: Aurum Hedge Fund Data Engine, presented on an equally weighted basis

-

Larry Fink – Blackrock Outlook Webcast 19th January 2021.