Hedge Fund Data

Quant strategy deep dive

30/09/2020

1 min read

12-month review to August 2020

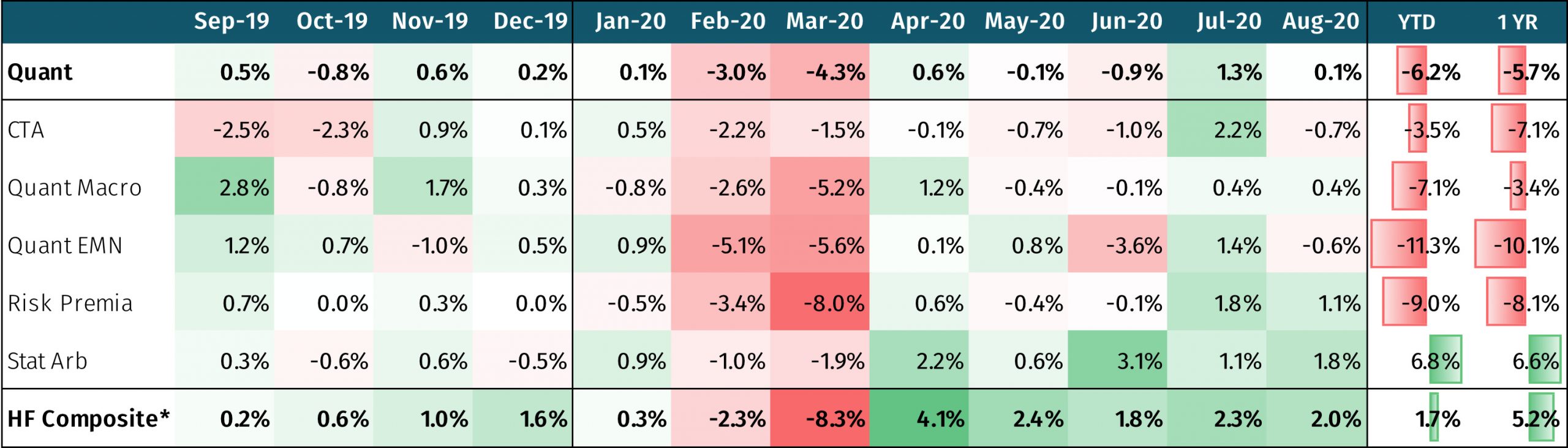

The last 12 months have been extremely challenging for the quant space as a whole. Quant hedge funds monitored by the Aurum Hedge Fund Data Engine delivered a net return of -5.7% on an asset-weighted basis, significantly below the Aurum Hedge Fund Composite Index*, which returned 5.2%. With the exception of statistical arbitrage (stat arb), all sub-strategies within quant were also negative for the period. Overall, the observed quant space AUM has shrunk in size, due in equal measure to net outflows and poor performance.

Net Return of Master & Sub-Strategies